This is the third and final post in the series China-Canada Investment “Straitjacket:” Exclusive Interview with Gus Van Harten. You can access Part 1 here and Part 2 here.

Canada has already begun the short countdown to the day the China-Canada Investment Deal becomes ratified in the House of Commons, although the nation has been granted no opportunity to clarify or discuss the full economic or environmental significance of the agreement – the most significant in Canada’s history since NAFTA.

Prime Minister Harper, who signed the agreement in Vladivostok in September, is forcing this deal through with such force and brevity it makes the undemocratic Omnibus budget bill C-38 look like a dress rehearsal.

International investment lawyer and trade agreement expert Gus Van Harten has landed center-stage in the controversy as one of the only figures willing and qualified to speak up against the investment agreement. He told DeSmog that Canada’s rush to enter into an investment deal of this sort endangers Canadian democracy, threatens Canadian sovereignty and could fracture the government’s loyalty to its people.

In this post, the final segment of our interview with Van Harten, he discusses in more detail just how bad this deal is for Canada economically and how much it threatens to corrupt our way of doing business.

Below is Part 3 of our interview:

Carol Linnitt: I’ve got a couple other questions for you. Maybe I’ll ask you about transparency. So, any challenge that Chinese investors might pose to the Canadian government in regards to legal frameworks, this all can happen behind closed doors, in the sense that the Canadian public will have no idea that this is happening whatsoever, and have no possibility of even participating in a discussion about the outcome or the decisions the Canadian government makes.

Gus Van Harten: In the arbitrations, the only parties that have a right to standing are the national government of the country that’s been sued, the federal government, and the investors. No one else, native groups in BC, the British Columbia government, domestic Canadian companies, even if their rights or interests are affected directly by the occasion, let’s say their reputation is affected, they have no right of standing. That is because it’s an international arbitration, so it’s not exceptional in that context.

What’s exceptional is that they allow this private investor to go into the international arbitration, but no other private party. The point is, the Canadian government reserved the right in the treaty to keep claims by Chinese investors against Canada, against the Canadian governments, to keep those confidential if the Canadian government decides that it is in the public interest to do that.

So that raises the question, when will the Canadian government think it is not in the public interest to tell Canadians that Canada has been sued by a Chinese investor? The treaty clearly contemplates that there will be such situations. If the government wanted to make all of these claims public, it could easily have done so in the treaty, because that’s what it has done in the past treaties, that it signed with countries like Romania for example.

CL: Okay.

GVH: So we can presume that some or many or even all of the arbitration claims may not in fact be made public. That is, the hearings may not be made public and documents associated with the arbitration may not be made public. I should stress, the treaty does provide for any awards to be made public, but also important are the submissions that the parties are making in the arbitration, especially our own government on our behalf. Those should also be public, but the government has said that it can keep them confidential if the government considers it to be in the public interest under the treaty.

CL: This is interesting too because if we are looking at this deal as a great economic opportunity in terms of Canada’s doors being open to the fastest growing global economy in the world right now, is there additional element of say, economic entanglement that will complicate these issues further, if say we become reliant upon Chinese investment and also the availability of Chinese markets for our products. Does that add an additional layer of complication to the way that decisions will be made with this deal?

GVH: Well, what this deal is setting up is for us to play the role of the supplier of raw resources to feed the Chinese industrial machine. We will have difficulty competing with Chinese manufacturing because of the extremely low cost of labour in China. Because the lack of regulation of various aspects that we would regulate here, because of the immense amount of money the Chinese are investing in research and development, and because the Chinese are very quickly copying western technology, they in fact use foreign investment as a way to get access to western technology. So the Chinese strategy is to set itself up as the manufacturing centre, and that’s where the money is.

The real economic benefits is not taking the resources out of the ground, it’s adding value by manufacturing the resources and then exporting the manufactures. No country, or very few, has ever industrialised, and based its development on industrialisation, other than by setting up a manufacturing sector.

So we are, in a sense, setting up conditions when we will simply supply resources to manufacturing in China. And that in a way is a kind of economically dependent relationship, because you’re more vulnerable economically if your economy is too dependent on simply exporting raw materials and you leave the economic benefits from value-added activity and from the super profits that can come from developing manufactured goods that are the edge of the technology frontier. You give those opportunities over to China. And I think it’s quite clear that that’s the Chinese strategy and this deal fits right into it.

It would be more beneficial to Canada if the deal at least allowed Canadian investors to buy Chinese companies, on a relativity widespread basis. But the deal does not do that. Also there could be benefits in having a wider trade deal in that Canadian exports would have more favourable access to the Chinese market than other countries receive under the world trade organisation rules.

But we also haven’t got that because we were told there’s not going to be any trade deal for at least another ten years, if ever, so I think the Chinese have really got what they wanted out of this deal, and Canada did not get much in return if our aim was to counterbalance Chinese foreign ownership of our economy with opportunities for Canadian companies to own profitable assets in China or with opportunities to increase our ability to compete by exporting goods to China, other than obviously the raw materials in which the Chinese will own the rights.

CL: And we’ve already seen a major flagging of the manufacturing sector in Canada just by virtue of how much emphasis has been put on the export of raw materials, bitumen being just one of those.

[For the impact of the tar sands on the Canadian manufacturing sector, read the Pembina Institute’s “In the Shadow of the Boom: How Oilsands Development is Reshaping Canada’s Economy.”]

GVH: Yes, I mean, it’s pretty clear that the Harper government does not have as its priority support for the established manufacturing sector, and that its higher priority is to get investments into the resource sector to get the resources out of the ground and generate economic activity in that way. It’s not a bad short-term strategy if you want to create some growth, but as a long term strategy it’s not good because it puts too many of our eggs in one basket. And because resource prices are notoriously unreliable, and finally because if the resource extraction activities are owned by foreign companies, then over the long term they will be earning the profits from the exploitation of our resources rather than Canadian companies.

CL: And doing so under a rubric of foreign design that might not serve Canadian interests or the interest of local communities, or upholding the rights of First Nations.

GVH: Economically, socially, politically, culturally, it’s less in Canadian control.

CL: I’m so baffled that this kind of information hasn’t been highlighted by the media, who have been covering this topic, because I‘m just shocked at how bad this deal is, how much it doesn’t seem like a good opportunity for Canadians. Arguments in terms of economic security don’t even really hold. Speaking environmentally, which is such a relevant issue with climate and the tar sands right now, this is a disaster. And in terms of the pipeline, which is massively important on the west side of Canada, no one is talking about the significance of this deal for these issues that are in the spotlight right now.

GVH: Well, people don’t understand how the treaties work and that’s entirely fair, I mean it’s complex, but those who do understand them, lawyers and academics, you see, I would say most of them make significant income, either working for investors or for states in investor-state arbitrations, working as arbitrators in these arbitrations, or working as experts hired by the investor or the state in the arbitration.

I can’t say that there’s a massive conspiracy, but there’s certainly a link between the way in which some commentators frame the system and evaluate risks arising from the system and tend to, in my view, understate those risks, slip them under the rug. A link between that and their own career track, and their own career interests, is apparent.

Whether it’s actually those interests that influence them I don’t know, on an individual basis, but in terms of watching how the technical literature is written, how people comment publicly on the system, it seems to me that there is a legal and arbitration industry that has a lot of interest in these treaties, and less interest in how the treaties affect Canadian interests, for example, in our case.

CL: So the way that the treaty and this deal have been negotiated, it’s all said and done at this point, so it’s not as though the Canadian government could redefine its terms for example, at this stage.

GVH: Nothing’s completed yet, the treaty has not been ratified.

CL: Okay.

GVH: It’s been signed but not ratified, and it has to be ratified to come into effect. The Canadian government said, ‘look, it’s going to come into effect after we’ve put it before parliament for 21 days, and that’s it. We’re not going to have any public hearings about it; we’re not going to have a vote in parliament about it, of course it would probably win the vote anyway; we’re not going to put it to provincial legislators for a vote; we’re not going to put it to a referendum.’ This is going to be in force after 21 days, that’s sitting days of parliament, that’s it. But, in the meantime the government can change its mind. I don’t think they will, but at best it’s important to at least, at this time, make people aware of just how significant a long-term decision this is going to be.

CL: So what could you foresee being…how can we stop this? That’s the question I really want to ask.

GVH: Yes, other people are asking that question. I talked to one or two people about it and there are some ideas, but I’m not really that optimistic. Not through the legislative process because the government controls that. The provinces might object, and the courts might play a role, possibly, but I’m not really holding my breath. I know that some provinces are aware of this and are not happy about it. I hope the provinces do pay attention and that one of them might take action to delay ratification, but time is getting very short.

CL: Yes, very short.

GVH: For example, I would have thought the current BC government and the incoming NDP government in BC would not be very keen to hear about how its options with respect to the northern gateway pipeline might be frustrated by this deal.

CL: That would have been my next question, that is, what is BC’s stance? So that’s interesting. Perhaps some really, really outspoken provincial opposition could sway public opinion about the benefits of this deal.

GVH: …to show how this deal appears designed to stop BC from blocking the Northern Gateway Pipeline.

CL: That would definitely be relevant for people to be thinking about right now. It’s hard not to be blindsided by some of the unexpected elements in the pipeline argument, you know, between provincial legislation and federal legislation, the transformation of our laws while the hearings are in place, that affect those hearings, province to province deals; it’s had to wrap your mind around who actually has the decision making authority when it comes to this pipeline, and this is a really interesting new element to add to this whole issue.

GVH: Yes, I assume that here are people in the provincial governments that are looking at this, but I don’t think there are very many who really understand the implications fully.

CL: And people who are in those positions have a thousand things to juggle, and just to wrap your head around this treaty and to get the details of it straight is a lot of work, and it’s the kind of complications that don’t play out well in the media. It’s difficult to try to inform people about these kinds of things because of the sorts of technicalities difficulties involved.

GVH: It’s complicated, true. And a government can always throw up some lawyer in a suit to say, ‘oh no, it’s fine’.

CL: Okay, I just have one last question for you. I wonder if you’re familiar at all with the ‘Ethical Oil’ campaign.

GVH: You mean Ezra Levant’s thing?

CL: Yes, yes.

GVH: Vaguely, I didn’t really pay much attention to it.

CL: Well it’s still in play as as public opinion machine that is very active. In relation to the China-Canada deal, one Ethical Oil writer named Jamie Ellerton has written two pieces on Huffington Post Canada, arguing that Canada’s oil will still be the most ethical oil in the world, even if China has a massive stake in the oil sands. He’s saying our human rights record, our way of doing business, all of these things will persist, even if other international players who don’t have good human rights records are involved, or we’re entering into partnerships with them.

[Read: Ellerton’s “No Foreign Investments Can Tarnish Our Ethical Oil” and “Just Because They’re Communitsts Doesn’t Mean We Can’t Do Business With Them.”]

And that’s, for me, a very frustrating narrative that is emerging when we’re discussing things like the oil sands. I feel like there’s more serious conversations to be had and arguments in favour of ‘ethical oil’ are simply emotional fodder and not at all the specific conversations we need to have about Canada’s economy, energy diversity, climate action, First Nations rights, democracy and the significance of our decisions for future generations.

So I would like to counteract that narrative, and I’m wondering if you could talk about the meaning of this deal for Canada in term of Ellerton’s argument. If we consider ourselves responsible actors, and we have a good human rights record, could something like this deal have the capacity to transform that side of Canada? That way of doing business? How would that happen, what would that look like, what’s the potential for Canada’s position on those types of issues to change?

GVH: I think that’s a bit more removed, I mean it’s just a bit more speculative. As to how this deal might undermine our reputation for ethical oil, I think the debate about whether Canadian oil is ethical, is really about something fundamental about the tar sands, and whether that oil should ever be taken out of the ground, because it’s going to go into the atmosphere in carbon, and if it does, if a large amount of it does, the risks in terms of climate catastrophes are obviously going to be higher. So I am not sure this deal really accentuates, or somehow undermines, the case that otherwise would be in place for ethical oil.

CL: The side of it that I’m trying to pick up on is the issue of sovereignty. We may be able to say right now that Canada has great management structures in place, and equitable regulatory frameworks, and so on and so forth, even though I don’t think that’s the case, especially with first nations and…

GVH: I guess perhaps the point is, you can’t really talk about Canadian ethical oil anymore: it’s really Chinese oil. It’s Chinese oil that, because of this deal, is insulated from regulations and legislation in Canada, so this deal makes it increasingly Chinese oil. Rather than Canadian. It comes out of the ground in Canada, but many of the decisions about whether and how to take it out of the ground are going to be made by the Chinese investors. And they’re going to be able to avoid, potentially, attempts by the Canadian parliament or a provincial legislature, Canadian governments, to put environmental, health and other kinds of standards on the exploitation of that resource.

CL: I guess the reality is that by going ahead with this deal we are relinquishing some of our decision-making authority about the way that these resources are developed. So you can’t just blanket it and say that this oil’s developed according to Canadian values, because that will no longer be the case. And, in fact, I don’t think it is the case right now. But, this is just a perfect point in case, where we are relinquishing our authority and our value base will change accordingly.

Well, that gives me a lot of important material to work with. I’ll be in touch with you, thanks again for your time, I really appreciate it.

GVH: Okay, well good luck with your writing.

CL: Yeah thanks, and you too. Nice to talk to you, bye.

[END OF INTERVIEW]

Gus Van Harten continues to write on the topic and has recently addressed an open letter to Prime Minister Harper and the Honourable Edward Fast, Minister of International Trade and Minister of the Asia-Pacific Gateway, urging them to halt the trade agreement’s ratification.

Van Harten’s research is freely available on the Social Science Research Network and the International Investment Arbitration and Public Policy website.

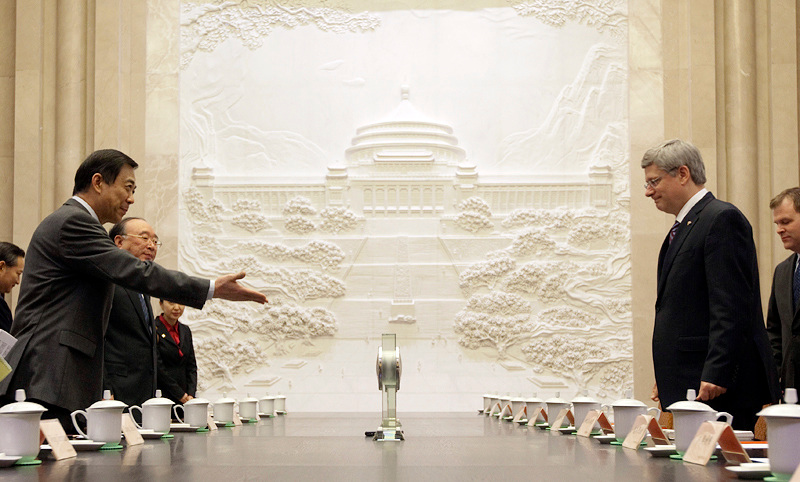

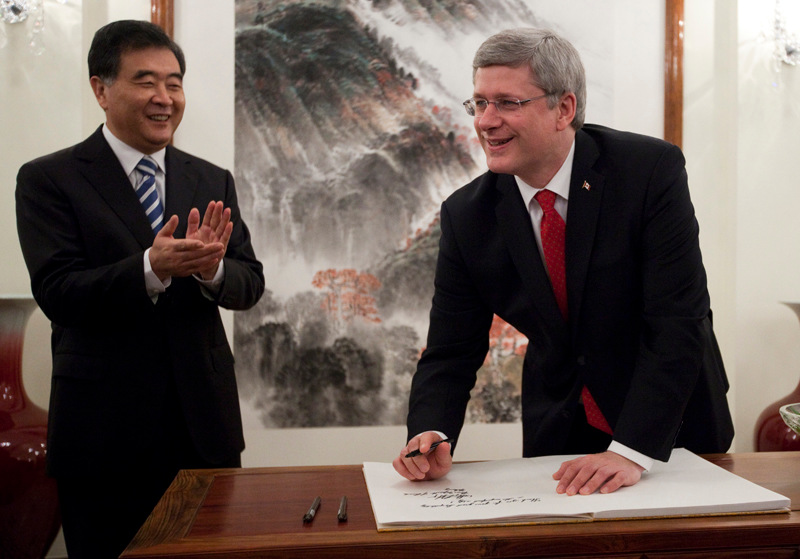

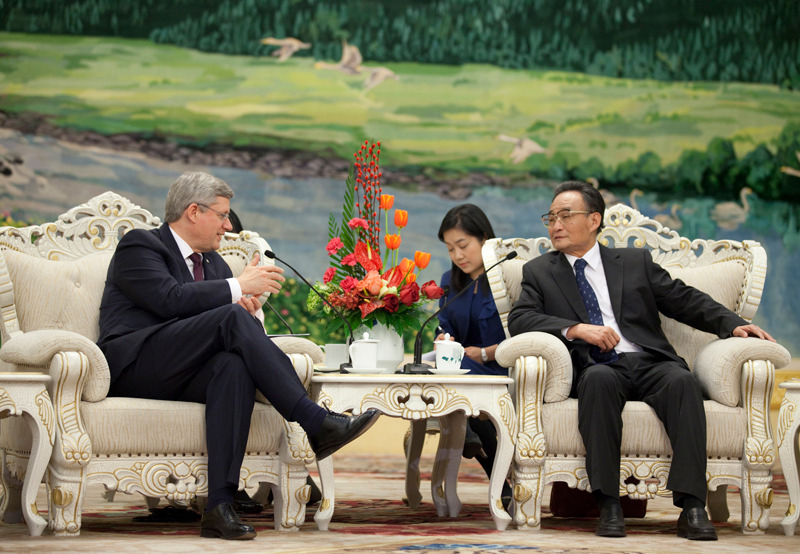

Images from the “PM visits China” photo gallery.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts