Facing enormous opposition to the proposed Keystone XL and Northern Gateway pipelines, Canada’s tar sands industry is taking to the tracks to get its sticky bitumen to China. Canadian and Chinese oil companies have explored the “pipeline by rail” option for years now, but over the past month, the prospect of tar sands trains has taken a few big steps closer toward reality.

For over a year, Calgary-based Nexen, Inc. has been developing plans to load tar sands crude onto trains for transport to the West Coast, where it would be loaded onto barges and shipped to China. Late last month, the Canadian government approved the sale of Nexen to a nationalized Chinese oil company, and earlier this week, the U.S. government, which has some say because of Nexen’s major operations in the Gulf of Mexico, gave its stamp of approval. According to Nexen, the company now has “all the requisite approvals” and the deal “is expected to close the week of February 25, 2013.” (So much for Canadian tar sands benefiting Canadians first and foremost.)

Rail is considered more and more appealing to industry insiders as numerous plans to ship tar sands crude by pipeline have grown increasingly controversial and have been stalled by climate and private property activists from British Columbia to New England to Nebraska. (See: the Keystone XL, the Northern Gateway, and Trailbreaker/Enbridge Line 9.)

In fact, the industry is growing desperate to find ways to export the heavy Canadian crude, as export pipeline capacity is currently maxed out, causing a glut in supply in Alberta, which is driving down prices and causing, according to the Globe and Mail, “billions in forfeited revenues.”

Nexen – now under the control of the the China National Offshore Oil Corporation, or CNOOC – hopes to deliver tar sands crude via train to Prince Rupert, British Columbia, where an export terminal would be built on federal lands to offload the oil onto China-bound tankers. The Globe and Mail explains the startlingly simple regulatory path to rail-facilitated exports:

Prince Rupert possesses North America’s deepest natural harbour and the shortest distance to many Asian ports from any port outside Alaska. The use of already-built track could also skirt some of the regulatory conflict provoked by Northern Gateway, the planned Enbridge Inc. pipeline to the B.C. coast. Though environmental scrutiny would be applied to the construction of tanks and a terminal, oil can move freely today on train tank cars.

So the tracks exist already, the harbor is seen as ready to go, and the only real hurdle for the industry will be the construction of storage tanks and the physical export terminal itself.

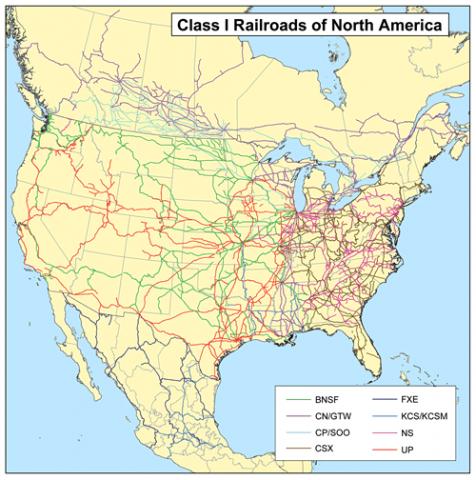

For reference, on this map, you can find Prince Rupert at the western terminus of the northernmost rail line in British Columbia. (The CN/GTR line, or Canadian National/Grand Trunk Railway line.)

This isn’t the first time we’ve discussed oil trains here on DeSmogBlog. A few months back, I explored the growing trend of “pipeline by rail” here in the United States. While that piece was mostly about oil from the Bakken Shale finding its way via rail to coastal refineries, it also noted that there is already a fair amount of tar sands crude crossing the Canadian-U.S. border, bound for the Gulf and East Coasts.

I also broke down how much easier it is to gain regulatory approval for trains. Not that this mode of transport is free of risk, as this Globe and Mail article from January explains:

Though accidents remain infrequent, trains leak hazardous materials more frequently than pipelines, have a higher accidental death rate and produce greater emissions.

But wait, there’s more:

But underlying the euphoria is a set of unpleasant statistics. Trains may deliver big new profits to oil companies and refineries alike. They also deliver the potential for problems. The industry itself acknowledges that trains have nearly three times the number of spills as pipelines. The U.S. State Department found that, when moving liquids, trains have a death rate three times higher than pipelines and a fire or explosion rate nine times higher.

This isn’t to say that oil trains are more important to fight than pipelines. Nor that the current battles over Keystone XL and Enbridge’s Line 9 and the Northern Gateway should be forsaken.

But it is, as I wrote a few months back, “a reminder that, above all else, demand is what drives the oil boom,” and that as long as there is strong demand, oil is always going to keep finding a way to refineries, and the plundering of the tar sands will continue to expand dangerously for the global climate.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts