Today, billionaire clean energy philanthropist Tom Steyer held a press conference to debunk the myths that the Keystone XL pipeline will lead to major economic growth and national security.

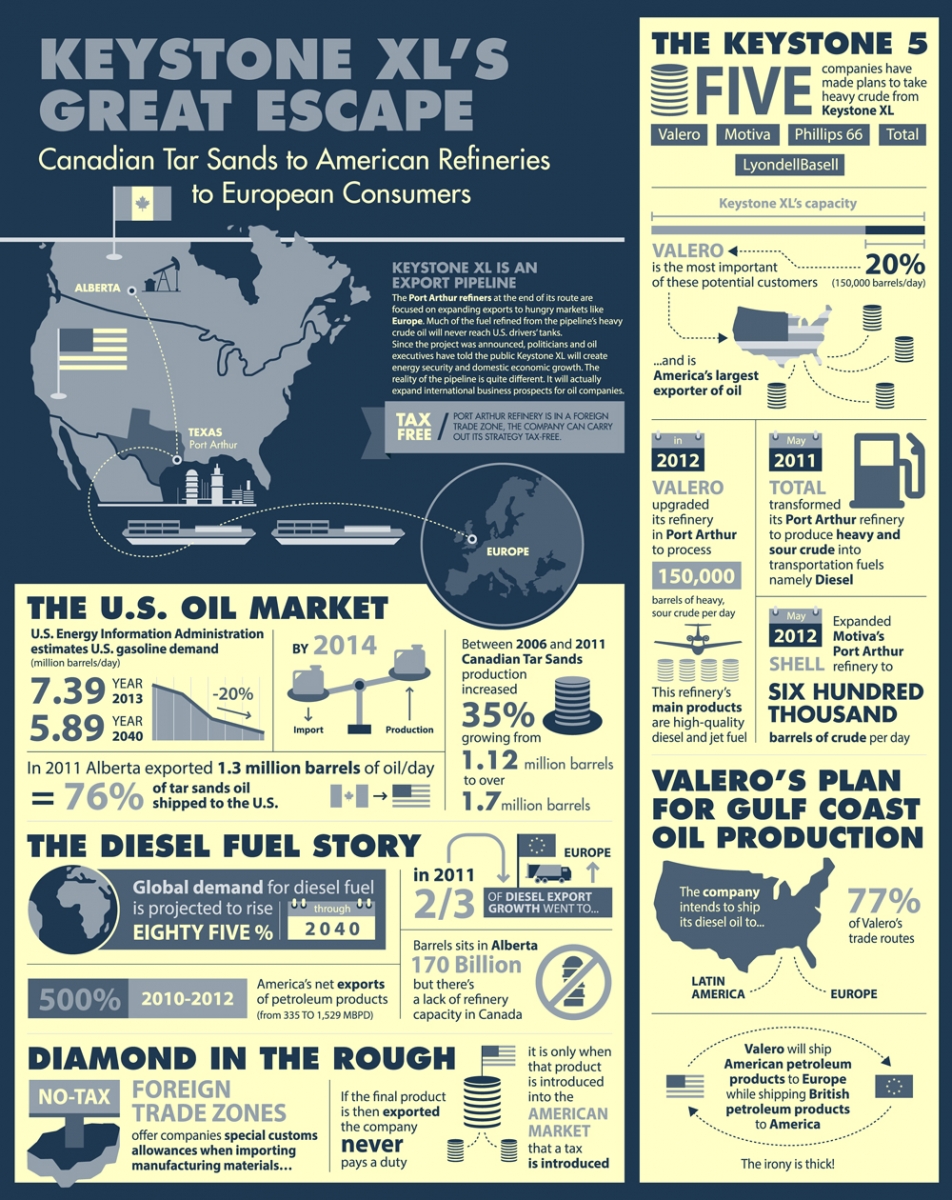

Keystone is an “export pipeline” that would transport toxic tar sands from Alberta down to a tax-free zone in Texas and out to foreign markets.

In other words, the EU, China and Latin America get the oil, the foreign-owned oil companies get the profits and North Americans are left cleaning up oil spills and shouldering the pollution burden from extracting and refining the dirty tar sands. It’s a complicated issue for sure, so I’ve tried to break out the main points in an infographic. Please feel free to download and share it. All the information has been fact-checked and verified by energy policy experts.

Here is the high-resolution version for download.

Taking into account the fundamental data from the U.S. and global oil markets, the Texas refineries processing the diluted bitumen, and the commitment of oil companies to selling their product for the best price internationally, it is easy to claim that Keystone XL offers greater energy security and economic growth, just not in America.

Europe, China and Latin America will have more energy security thanks to a massive fuel pipeline they can tap as long as they’re willing to pay. Additionally, oil companies will have a new bounty of profit to play with.

Yes, some of that will fall back into American hands, but not as much as if the majority of the products refined in Texas were sold in America, or if the refineries were not located in a Foreign Trade Zone and had to actually pay a tax on their products. As for the promise of new jobs, there is a short-term influx of cash for constructing the pipeline, but the latest estimates find that there will only be about 35 permanent jobs over the long term.

These pipelines, once built, demand very little maintenance. That is, of course, until there is an oil spill.

In making the final decision on whether to approve the Keystone Xl pipeline, it comes down to whether President Obama is comfortable with further enriching big oil companies that are already the most wealthy companies in the world, for the long-term pay off of 35 permanent jobs and the oil spills that will inevitably occur.

With the significant costs to American public health from refinery pollution, threats to water supplies from oil spills, and the implications that tar sands expansion has for global climate disruption, it seems like a no-brainer to me.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts