With many eyes honed in on the Powder River Basin coal export battle in the Northwest, another coal export boom is unfolding on the U.S. Gulf Coast. Although no coal production is actually taking place here, a filthy fuel with even more severe climate impacts than coal is leaving port bound for foreign power plants.

Meet petroleum coke, or “petcoke,” what Oil Change International described in a Jan. 2013 report as “The Coal Hiding in the Tar Sands.”

Petcoke “is a byproduct of coking, a process that takes very heavy oil and produces gasoil (a precursor to diesel or vacuum gasoil) and naphtha,” Platts explains. “The coke is used as a fuel for power plant, in a kiln in the production of concrete or, for some specialty grades, in the production of aluminum or other metals.”

As relayed by Platts, the Energy Information Agency (EIA) is reporting the U.S. exported the second-highest amount of petroleum coke in U.S. history in April. EIA‘s April data show export levels of 17.78 million barrels, second only to Dec. 2011’s 20.44 million barrels of petcoke.

With the tar sands’ expansion has come an accompanying petcoke export boom of historical proportion.

“The US exported a record 184.17 million barrels of petroleum coke in 2012, a record up over 20 million barrels compared to 2010,” Platts explained.

According to the EIA report, China is the current top beneficiary of the U.S. petcoke export boom, importing 3.20 million barrels of petcoke in April, the third most it’s ever imported from the U.S.

China imported 4.93 million barrels of petcoke from the U.S. in Dec. 2011 and another 3.64 million barrels in Jan. 2013.

Climate Costs of Petcoke: Worse Than Coal

Petcoke, put bluntly, is dirtier than King Coal.

“Petcoke is over 90 percent carbon and emits 5 to 10 percent more CO2 than coal on a per-unit of energy basis when it is burned,” explains Oil Change International‘s report. “As petcoke has high energy content, every ton of petcoke emits between 30 and 80 percent more CO2 than coal, depending on the quality of the coal.”

Making matters worse, refineries nationwide have the capacity to manufacture petcoke, which could fuel a new global coal power plant boom.

“Of 134 operating U.S. refineries in 2012, 59 are equipped to produce petcoke including many of the largest refineries in the country,” wrote Oil Change International. “The proven tar sands reserves of Canada will yield roughly 5 billion tons of petcoke – enough to fully fuel 111 U.S. coal plants to 2050.”

The Keystone XL Connection

If Keystone XL is built to full capacity, it “would fuel 5 coal plants and produce 16.6 million metric tons of CO2 each year,” according to Oil Change International‘s report.

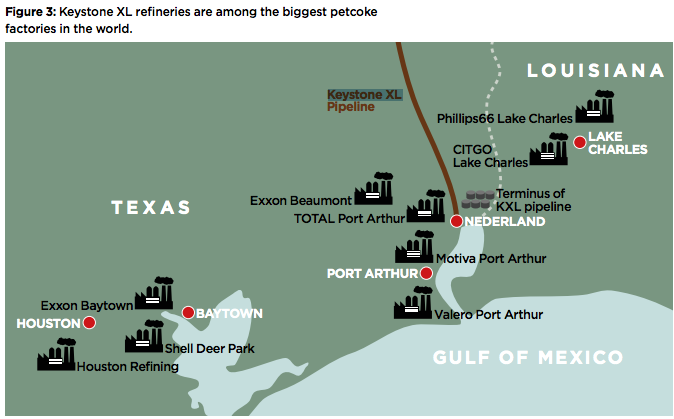

While Keystone XL is a tar sands crude export pipeline, it would also boost petcoke exports. Many petcoke refineries sit on the Gulf Coast, where the petcoke would then be exported to the global market.

“Nine of the refineries close to the southern terminus of Keystone XL have nearly 30 percent of U.S. petcoke production capacity, over 50,000 tons a day,” the report continues.

Image Credit: Oil Change International

As the recent EIA report makes clear, the petcoke production boom and its accompanying petcoke export boom are the new elephant in the room in the debate over tar sands production, marketing, and most specifically, Keystone XL.

“Petcoke is a seldom discussed yet highly important aspect of the full impacts of tar sands production,” wrote Oil Change International. “Factored into the equation, petcoke puts another strong nail in the coffin of any rational argument for the further exploitation of the tar sands.”

Image Credit: Oil Change International

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts