This is a guest post by Victor Menotti, Executive Director of the International Forum on Globalization.

Charles and David Kochs’ communications crisis team from the Center for American Freedom (CAF), along with Tim Worstall writing in Forbes, are countering International Forum on Globalization’s (IFG) recent report, “Billionaires’ Carbon Bomb: The Koch Brothers and the Keystone XL Pipeline,” only one day after its release and before IFG had a chance to respond to CAF‘s queries.

IFG stands firmly by its findings that the Kochs could profit plentifully from the proposed Keystone XL pipeline (KXL), and that KXL is not in America’s national interest. With a decision due any day, we also wonder why a U.S. president would approve a pipeline whose biggest beneficiaries could be the very billionaires who have spent millions of dollars to undermine his efforts. The Kochs’ current net worth ($92B) exceeds that of the world’s wealthiest man, Bill Gates ($72B), according to the October 1, 2013 Bloomberg Billionaires’ Index.

Forbes’ reporter, Tim Worstall, also attacked IFG’s 2011 report by arguing that people who profit from the production of fossil fuels play no role in promoting their use, nor in financing efforts to prevent their phase out. Worstall wrote, “Oh, sure, the rich guys turn a penny or two on supplying us with these things that we desire and use but it is our desire and use which is causing the problem, not the people doing the supplying.” IFG’s 2012 report showed the Kochs outspent all other oil companies—even Exxon— to block U.S. efforts to reduce carbon emissions and advance clean energy.

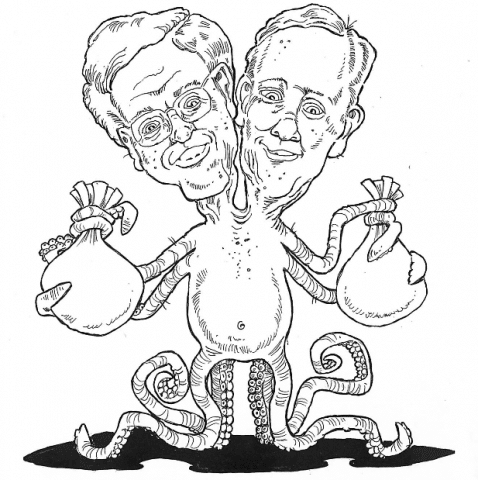

CAF was created by the Kochs in 2012 to counter increasing public scrutiny of the billionaire brothers’ record spending on a sprawling political influence network whose money, organizational structure, and unprecedented scale have been mapped extensively in IFG’s online, interactive Kochtopus. CAF’s Washington Free Beacon staff writer, Lachlan Markay, came from the Heritage Foundation, where he was the conservative think tank’s first investigative reporter.

Below is IFG’s official response to their claims:

1. Forbes accepts IFG’s basic premise as valid but then challenges IFG as confusing revenues versus profits. However, it is Forbes that confuses Kochs’ costs as including KXL’s construction as well as its maintenance, which are the pipelines’ owners, Transcanada, and not to be subtracted from any Kochs’ revenues. IFG’s calculations, whose methodology is painstakingly explained in Box A on page 8 of our report, is clear that producers’ standard production costs are already included in our calculations and that we are talking about pure profit. IFG did not subtract the Kochs’ $53M given to front groups pushing for KXL’s permit, since this could more accurately be considered an “investment.”

2. Koch counters the claim of its own former geologist who helped Koch Exploration Canada to purchase two million acres, as quoted in the Pulitzer Prize winning publication, Inside Climate News. Kochfacts.com failed to counter these claims of acreage (though they made detailed attacks against other assertions in the article), and IFG’s attempts to confirm the actual amount of Koch prior to publishing “Billionaires’ Carbon Bomb” were rebuffed by KEC staff. IFG’s report acknowledges that only the Kochs know how much acreage they hold in Alberta, so we would welcome the Kochs’ full public disclosure of all acreage in Alberta, as well as their others assets involved in the tar sands trade.

3. CAF wrote to IFG: “The report notes on page 10 that Koch would have to produce 8 billion barrels of oil to offset reduced revenues for the Pipe Bend Refinery. Koch tells me that they don’t think they will accomplish that benchmark. Do IFG‘s calculations suggest otherwise?” “Pipe Bend” is CAF’s apparent error for the Kochs’ Pine Bend, Minnesota oil refinery, which currently processes about one-quarter of existing tar sands imports.

IFG’s calculations are based on former Koch geologists’ reports of helping Koch purchase two million acres in Alberta (equal to 32 billion barrels of recoverable reserves), from which IFG conservatively estimates that only half of the barrels of oil from this acreage (16 billion barrels) would be profitably produced. Koch claims that it won’t surpass 8 billion barrels is, firstly, an admission of its plans to produce billions of barrels of Canadian crude from tar sands. Secondly, it stands in direct contradiction to the Kochs’ clear patterns of political spending; indeed, it is almost impossible to imagine that the profit-driven Kochs would give $53M to front groups who advocate for Keystone if KXL would be a “net negative financially for Koch,” not to mention that Koch-funded Tea Party members of the House of Representatives would include passage of KXL as one of four “core conditions” in its budget bills approved before the recent 16-day shutdown of the U.S. government. The Kochs could convincingly counter IFG’s calculations by full public disclosure of its actual acreage in Alberta, and showing conclusively that they have an amount of acreage whose potential profits will not exceed their potential reduced profits from its Pine Bend refinery.

4. Koch spokesperson Melissa Cohlima claims “Keystone XL will be a net negative financially for Koch,” due primarily to a reduced flow of Canadian crude to the company’s Pipe Bend Refinery, and that KXL will mean “less Canadian oil sands coming into our Pine Bend Refinery, thus reducing the amount of we are refining.” While IFG’s analysis anticipates (as do Canadian producers) that the price of Canadian crude will increase due to KXL, Cohlima’s claim that KXL will reduce the flow of Canadian crude is counter to the entire premise of KXL’s purpose: to increase the flow of Canadian crude to US refineries. IFG’s report only attempts to give the public some credible, quantifiable sense of scale of how much the Kochs might profit form KXL, based on information from ex-Koch employee as well as from established experts in energy investment contracted by IFG.

5. Koch counters that its Port Arthur, Texas hub of Koch Pipeline Company does not carry crude oil yet IFG does not claim that it currently carries crude oil (since KXL does not exist), nor do we include any potential KPC profits in our projections. Even if Kochs’ Port Arthur hub transports only chemicals, they could surely benefit since several categories of chemicals are created as by products from the refining process of crude oil. Only the Kochs know what they carry in their pipelines and we would welcome a commitment from Koch not to carry any Canadian crude through its pipelines.

6. IFG also notes what Koch did NOT challenge, particularly our assertion that Koch may make MUCH more money from their unregulated trading of oil derivatives due to their expanded influence over energy supplies, shipping, storage, et. al. Nor did they challenge the claim that they will spend some of their profits on expanded attacks against carbon pollution laws, labor rights, voting rights, and other extremist agendas.

The Kochs’ record makes clear that their making more money will only empower the very extremists who more and more Americans view unfavorably, and that approving the pipeline will not be in America’s national interest, nor the interest of our rapidly warming planet.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts