In its environmental assessment of the proposed Keystone XL pipeline, the U.S. State Department severely underestimated the project’s impact on oil production, and the resulting greenhouse gas emissions.

That’s according to a rigorous economic analysis published in a new report by the Carbon Tracker Initiative. Researchers found that, if constructed, the Keystone XL pipeline would increase global greenhouse gas emissions by roughly a whopping 5 gigatons over the course of its lifetime. For some perspective, that’s the equivalent of the annual emissions from 1,400 coal-fired power plants or 1 billion automobiles, according to the report’s authors.

As you may recall, in a speech last June at Georgetown University, President Obama explicitly stated that he would approve the pipeline “only if this project doesn’t significantly exacerbate the problem of carbon pollution.”

In its recent environmental assessment, the State Department’s suggested that the pipeline is “unlikely to significantly impact the rate of extraction in the oil sands,” thereby implying that it would pass President Obama’s stated climate test.

However, the Carbon Tracker report, called Keystone XL: The “Significance” Trap (pdf), proves otherwise.

Using the State Department’s own numbers, Carbon Tracker researchers determined that the Keystone XL pipeline, if constructed, would increase the rate of extraction of tar sands, to the tune of roughly 510,000 barrels per day of bitumen (or roughly 730,000 barrels per day of DilBit, after dilution to allow it to flow through the pipeline). As Carbon Tracker researchers put it, “There is over 510kbpd of bitumen production which would benefit from even the narrowest improvement of margins.”

Introducing the report on a call to reporters Thursday, Tom Steyer, founder of NextGen Climate, who stated that he did not fund the research, called Keystone XL “the economic key to unlocking the tar sands and significantly expanding production, which would have major consequences for our climate.” Steyer explained that the State Department analysis “didn’t fully consider how the pipeline would impact the economics of tar sands extraction for producers,” an omission that the Carbon Tracker Initiative researchers set out to address.

Mark Fulton, a former economist with Deutsche Bank and one of the report’s authors, said on the call that the State Department’s biggest mistake was assuming that all of the transport capacity of the Keystone XL pipeline would be replaced by the construction of other new pipelines, the expansion of existing pipelines, or by rail. Fulton explained that the true economics of transport costs don’t back up that assumption.

The economic analysis is a bit complicated, but basically reveals that the price of oil would have to be higher in order to make shipping by rail profitable, a fact that the State Department’s assessment failed to consider.

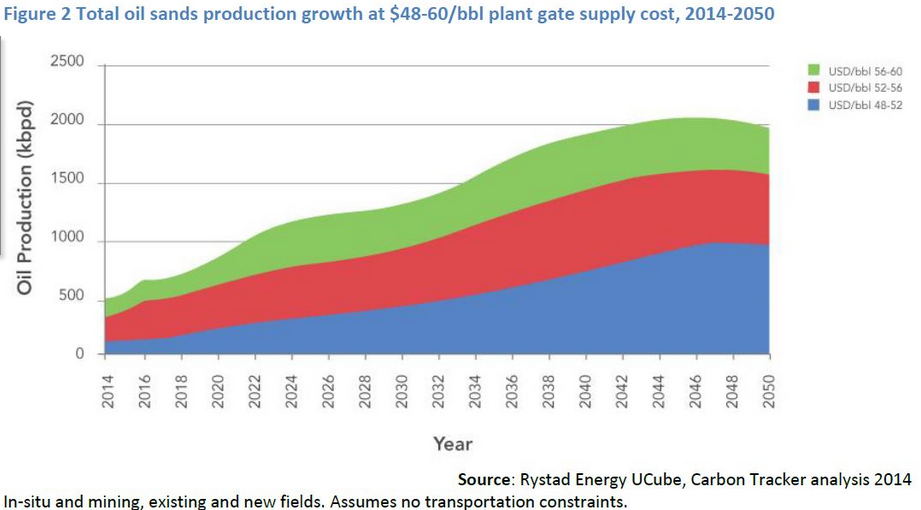

“Following through the numbers in the [State Department’s] Keystone XL market analysis, we found there is a significant amount of production that could be eneabled by the pipeline with a production cost of $48 to $60 [per barrel of oil],” said Fulton. This is charted out in the graph below, which shows how much more oil would be produced at various production cost ranges. Keystone XL would bring production costs down within the ranges charted below.

Carbon Tracker’s research actually backs up the public claims that the tar sands industry and its boosters in the Canadian government have made about the necessity of the pipeline for expanding production. The CEO of tar sands giant Cenovus recently told The Globe and Mail that “if there were no more pipeline expansions, I would have to slow down.”

Joe Oliver, Canada’s Natural Resources Minister, said, “In order for crude oil production to grow, the North American pipeline network must be expanded through initiatives, such as the Keystone XL Pipeline project.”

In essence, construction of the Keystone XL would fundamentally change the economics of tar sands production, lowering transport costs and increasing the price that could be fetched by the oil by delivering it for export to the global market.

“Right now they don’t have ability to get it to world oil price,” explained Steyer. “They’re selling it locally at big discounts. [Keystone XL] changes the economics between the transport costs and realizable price of oil. The pipeline changes the economics of tar sands and enables much more of it to be producible at a profit.“

“These findings only confirm, in a big way, that Keystone XL does not pass the president’s climate test and is not in the national interest,” added Steyer.

Photo: President Obama in front of portions of Keystone XL‘s southern leg in Cushing, Oklahoma, by Matt Wansley

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts