The U.S. Senate failed to get the necessary 60 votes to approve the northern leg of TransCanada‘s Keystone XL pipeline, but incoming Senate Majority Leader Mitch McConnell (R-Ky.) already promised it will get another vote when the GOP-dominated Senate begins its new session in 2015.

Though the bill failed, one of the key narratives that arose during the congressional debate was the topic of whether or not the tar sands product that may flow through it will ultimately be exported to the global market. President Barack Obama, when queried by the press about the latest Keystone congressional action, suggested tar sands exports are the KXL line’s raison d’etre.

Obama’s comments struck a nerve. Bill sponsor U.S. Sen. Mary Landrieu (D-La.) and supporter U.S. Sen. John Hoeven (R-ND) both stood on the Senate floor and said Keystone XL is not an export pipeline in the minutes leading up to the bill’s failure.

“Contrary to the ranting of some people that this is for export…Keystone is not for export,” said Landrieu, with Hoeven making similar remarks.

But a DeSmog probe into a recent merger of two major oil and gas industry logistics and marketing companies, Oiltanking Partners and Enterprise Products Partners, has demonstrated key pieces of the puzzle are already being put together by Big Oil to make tar sands exports a reality.

And both Keystone XL and Enbridge‘s “Keystone XL Clone” serve as key thoroughfares for making it happen.

Oiltanking-Enterprise Marriage

On November 13, the day before the U.S. House of Representatives voted to approve Keystone XL North, Enterprise acquired Oiltanking. Both companies stand to gain from its prospective approval, as well as the recent approval of Keystone XL‘s Clone, and both companies have made big bets on fossil fuel exports at-large.

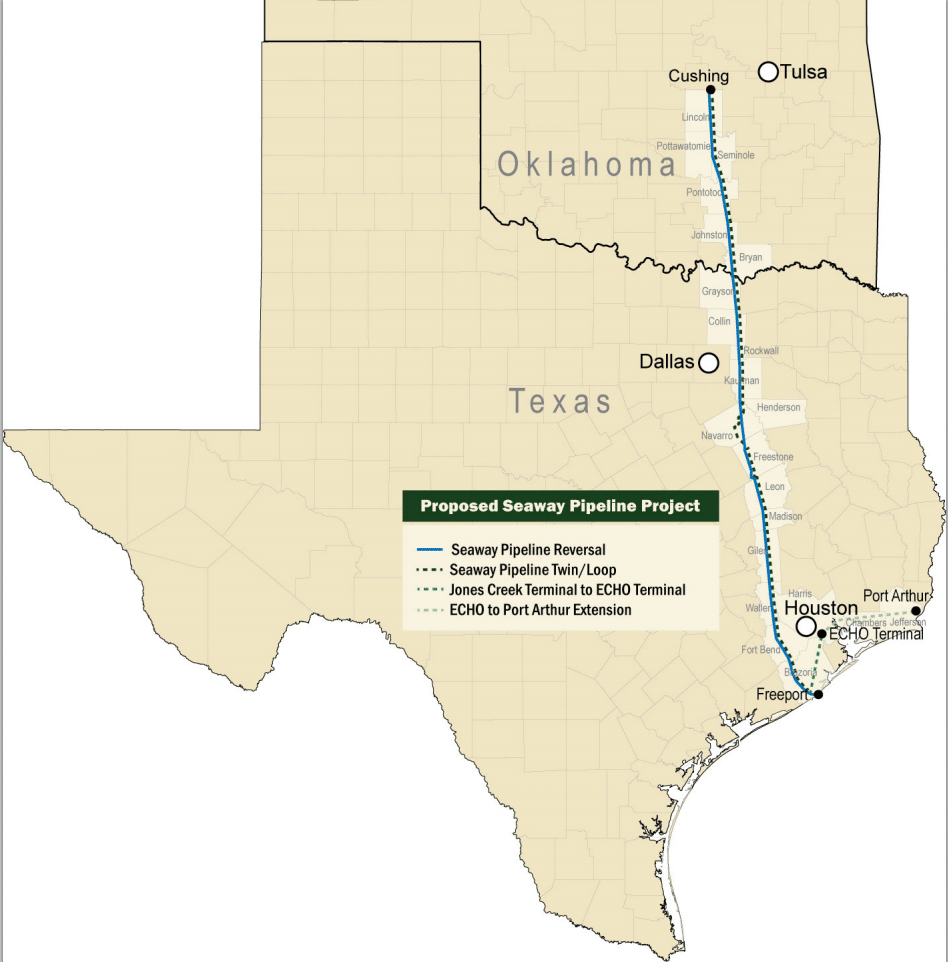

The Keystone XL clone — the Alberta to Freeport, Texas combination of Enbridge’s Alberta Clipper, Flanagan South and Seaway Twin pipelines — has a key tie to Enterprise Products. That is, Enterprise co-owns the Cushing, Oklahoma to Freeport, Texas Seaway Twin pipeline with Enbridge.

In June, Enterprise received one of the first oil export permits in more than four decades from the Obama Administration.

Oiltanking, in turn, owns two key Gulf-area terminals that will serve as a final destination for Enbridge’s tar sands diluted bitumen (“dilbit”). One of them sits in the Houston Ship Channel, while the other sits in Beaumont, Texas.

As covered previously on DeSmogBlog, Keystone XL South has a key fork in the road called the Houston Lateral Pipeline that will supply Houston’s refinery row with dilbit. An article published in RBN Energy by Sandy Fielden explained that TransCanada’s Houston Lateral will feed into Oiltanking’s Houston Ship Channel terminal.

Seaway Twin also has two lateral pipelines in the works from Freeport, one of which will deliver dilbit to the Oiltanking-owned Houston Ship Channel terminal.

Image Credit: Seaway Twin Pipeline

Enterprise: Oiltanking for Fossil Fuel Exports

The interconnected business plans of Enterprise and Oiltanking, with Enterprise accounting for 30 percent of Oiltanking’s sales prior to acquisition, further calls into question whether the pipelines have anything to do with “energy independence.”

Industry analysts agree.

“Some of it will stay in Gulf, some of it will leave,” Sarah Emerson, president of Energy Security Analysis, Inc., said in a recent Reuters article. “I don’t think anyone would have built if they thought the oil was just going to stay in the Gulf Coast, that is like bringing coal to Newcastle.”

Look no further than to Enbridge, which as DeSmogBlog pointed out in a recent article, has already begun exporting tar sands to the global market via its subsidiary, Tidal Energy Marketing. Traders told Reuters they expect tar sands exports to increase when Seaway officially opens for business in December.

LPG, Coal, Petcoke Exports

Oiltanking’s assets also serve as key terminals for exporting liquid petroleum gas (LPG), coal and petroleum coke (“petcoke”). Petcoke is a tar sands by-product currently exported from the U.S. at record rates.

Enterprise exports LPG from Oiltanking’s Houston Ship Channel terminal and it recently expanded its capacity to do so.

“Upon completion of the expanded facilities, Enterprise will have aggregate capacity to load in excess of 16 million barrels per month of low-ethane propane and/or butane,” explained a press release announcing the expansion.

In the coal sphere, Oiltanking purchased United Bulk Terminal as a wholly-owned subsidiary in 2012.

United Bulk Terminal ”is the largest dry bulk export terminal on the Gulf Coast and is considered a critical logistic link in coal and petroleum coke international supply chains,” its website explains.

In May, environmental groups filed a lawsuit against Oiltanking for “unpermitted discharge into the Mississippi River and significant build-up of coal in the batture and along the river’s edge.”

The groups alleged Oiltanking “failed on a daily basis to take all reasonable steps to minimize or correct the adverse environmental impacts resulting from its spilled wastes for at least the past five years, and continues to fail on a daily basis to minimize or correct the environmental impacts from its waste – including without limitation waste that is now located in the [Mississippi River].”

Photo Credit: Gulf Restoration Network

Tar Sands Exports Next?

Now that Enterprise has purchased Oiltanking, multiple business, industry and investor press articles have argued they did so as a forward-looking wager on the possibility of a wholesale lifting of ban on exports of U.S.-produced oil by the Obama Administration.

Bloomberg, for example, hailed it “the latest bet on the growing market for U.S. energy exports.” Others sang a similar song.

“Oiltanking Partners’ assets are strategically located to take advantage of U.S. oil exports if the four-decade prohibition is lifted,” declared an article in The Motley Fool, a popular investor press publication. “That access to water and ample storage capacity put Oiltanking Partners in prime position to export oil in the event of federal approval of such business.”

Investor credit-rating agency Standard & Poors also chimed in, giving the merger a BBB+ investment rating (among the highest grades possible) and taking note of the company’s export agenda.

Sen. Landrieu said those pointing out that Gulf-bound tar sands pipelines like Keystone XL are at least in part for export were “ranting.” But the reality is that if the industry and their investors get it their way, they will soon be festively raving all the way to the bank.

Photo Credit: Wikimedia Commons

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts