Additional Reporting by David Goodner

Former Texas Republican Governor Rick Perry has joined the board of directors at Energy Transfer Partners, a natural gas and propane company headquartered in Dallas, Texas that has proposed to build a controversial Bakken crude oil pipeline across Iowa.

The announcement, which appeared in Energy Transfer Partners’ February 3 Form 8-K filing to the U.S. Securities and Exchange Commission (SEC), comes as Perry faces two Texas state-level felony charges for abuse of power. Perry pleaded not guilty to both charges and District Judge Bert Richardson recently ruled against dismissing Perry’s case.

“It isn’t immediately clear how much Perry will be paid for his board position,” explained the Texas Tribune. “According to regulatory filings published on the company’s website, non-employee board directors were paid $50,000 a year in 2013.”

Despite the felony charges, Perry is still strongly considering a 2016 presidential run, according to a recent article published by the Associated Press, which reported he may make a final decision on whether or not to run by May.

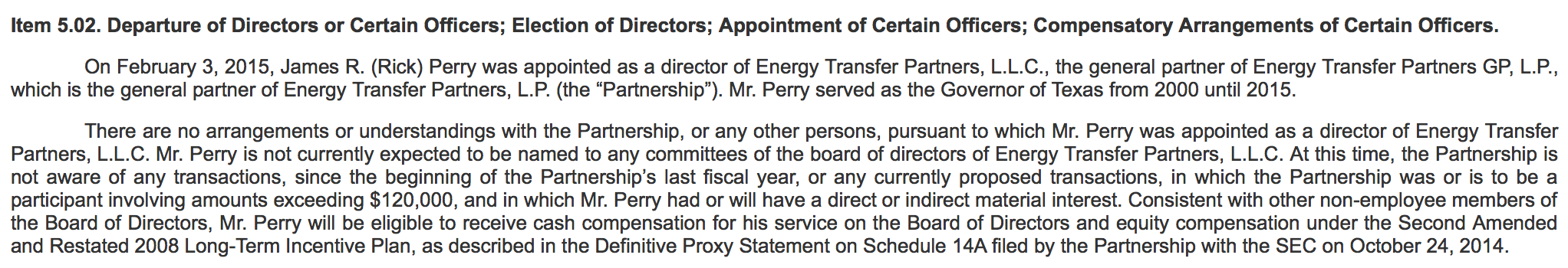

The Energy Transfer Partners filing to the SEC describes Perry’s appointment:

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.On February 3, 2015, James R. (Rick) Perry was appointed as a director of Energy Transfer Partners, L.L.C., the general partner of Energy Transfer Partners GP, L.P., which is the general partner of Energy Transfer Partners, L.P. (the “Partnership”). Mr. Perry served as the Governor of Texas from 2000 until 2015.

There are no arrangements or understandings with the Partnership, or any other persons, pursuant to which Mr. Perry was appointed as a director of Energy Transfer Partners, L.L.C. Mr. Perry is not currently expected to be named to any committees of the board of directors of Energy Transfer Partners, L.L.C. At this time, the Partnership is not aware of any transactions, since the beginning of the Partnership’s last fiscal year, or any currently proposed transactions, in which the Partnership was or is to be a participant involving amounts exceeding $120,000, and in which Mr. Perry had or will have a direct or indirect material interest. Consistent with other non-employee members of the Board of Directors, Mr. Perry will be eligible to receive cash compensation for his service on the Board of Directors and equity compensation under the Second Amended and Restated 2008 Long-Term Incentive Plan, as described in the Definitive Proxy Statement on Schedule 14A filed by the Partnership with the SEC on October 24, 2014.

Credit: Energy Transfer Partners

Bakken Pipeline Connection

Energy Transfer Partners owns the proposed Dakota Access pipeline, set to carry oil obtained via hydraulic fracturing (“fracking”) from North Dakota’s Bakken Shale basin to the southern Illinois town of Patoka.

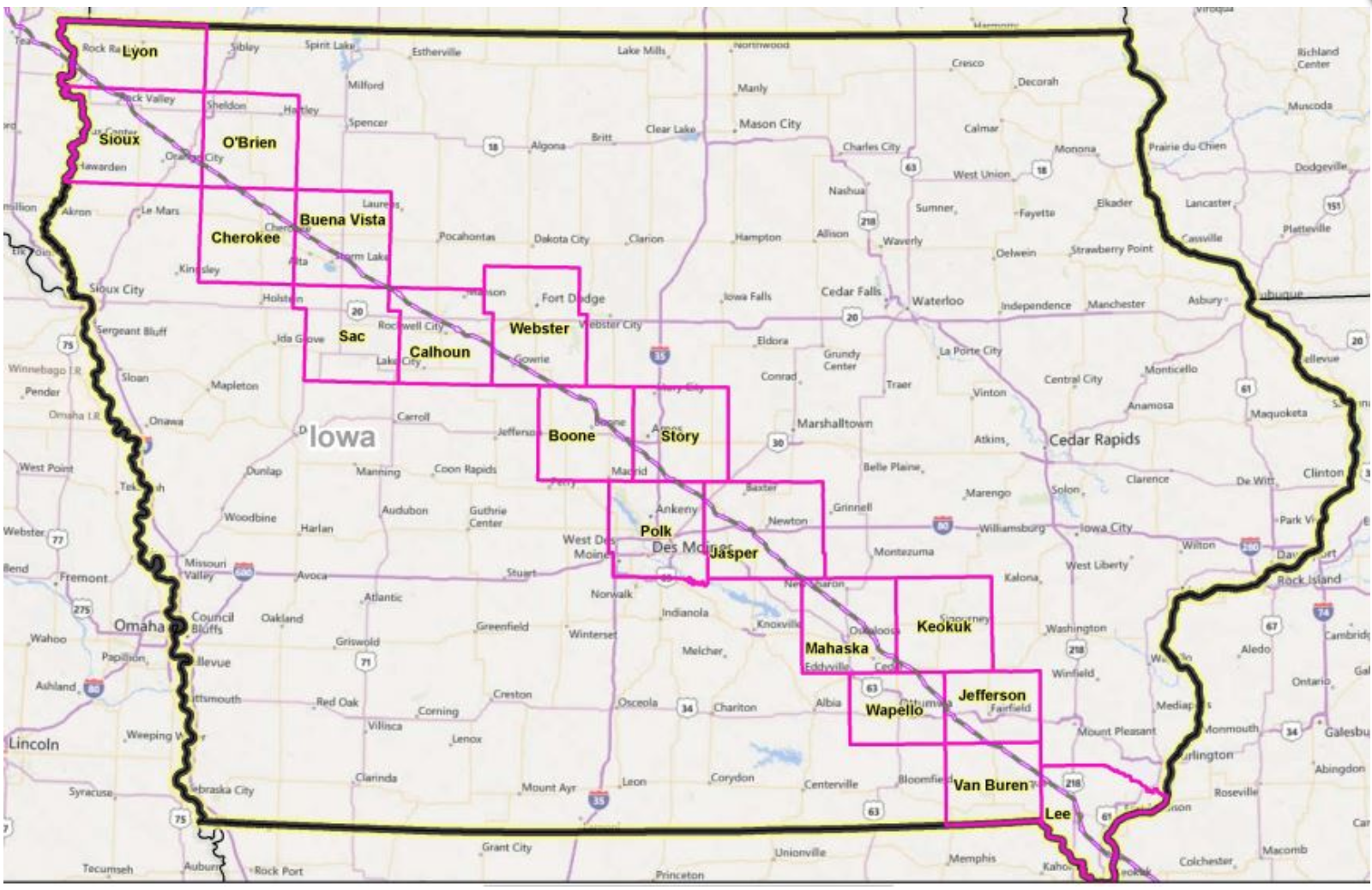

The Dakota Access pipeline proposal has faced a fierce backlash from environmentalists, farmers and other citizens living along the prospective route through Iowa. On February 2, the Bakken Pipeline Resistance Coalition introduced itself to the public, a consortium of 20 groups opposed to the pipeline.

“The Coalition is united to protect Iowa’s soil, water, communities, and the health of future generations by stopping the proposed Bakken crude oil pipeline,” reads the groups launch statement. “The controversial project would cross 18 of Iowa’s counties as well as major rivers, including the North Raccoon River, Des Moines River, South Skunk River and Mississippi River.”

Map Credit: Bakken Pipeline Resistance Coalition

All Roads Lead to Iowa

With a large portion of the Dakota Access pipeline set to go through Iowa, the growing controversy over Dakota Access could present a game of political hot potato in the run-up to the 2016 Iowa Caucuses.

Perry recently visited Iowa and spoke at the Iowa Freedom Summit alongside numerous other contenders for the GOP presidential ticket.

Iowa Republican Governor Terry Branstad has come out in support of the Dakota Access pipeline and told the Iowa State Legislature to avoid “political interference” in the review process overseen by the Iowa Utilities Board.

Perry hosted a fundraiser for Branstad in December 2013 in Houston, introducing the Iowa Governor to Texas Republican Party elite donors.

“Branstad declined to say how much money he took home from Houston, saying the contributions will eventually be made public when he files campaign finance reports,” the Des Moines Register reported about the trip. “No strings were attached to the Texas donations to his campaign, Branstad said, and he feels no obligation to endorse Perry for president in the 2016 Iowa caucuses.”

Branstad and Perry also appeared in an ad together in May 2014 in the run-up to the midterm elections, which saw Branstad win his race in landslide fashion.

Energy Transfer LNG Revolving Door

Energy Transfer Partners also owns the proposed Trunkline LNG export facility in coastal Lake Charles, Louisiana, which would ship gas obtained via fracking to the global market.

Perry is the newest addition to a long roster of powerful political officials who have passed through the government-industry revolving door and accepted a job either on a company Board or as a lobbyist for a company seeking to cash in on the fracked gas export boom. [Read our report on natural gas exports lobbying, produced by DeSmog and Republic Report: Natural Gas Exports: Washington’s Revolving Door Fuels Climate Threat]

According to lobbying disclosure forms, Adam Ingols — a lobbyist for Daryl Owen Associates and former chief of staff for the U.S. Department of Energy for President George W. Bush and special assistant for the Bush White House Office of Legislative Affairs — now lobbies for Energy Transfer Partners at the federal level.

The Texas Tribune also reported that Energy Transfer Partners is owned by Kelcy Warren, “a Dallas billionaire, [who] has been a major supporter of Perry’s political endeavors.” The Tribune reported that Warren gave $250,000 to Perry’s 2012 presidential Super PAC, Make Us Great Again, as well as “at least $20,000 for his 2010 re-election race.”

Warren is among the dozens of elite Republican Party donors who sit on the recently announced advisory board for Perry’s potential 2016 run for president, the Rick PAC Advisory Board.

At a January 28 news conference, Perry declared that the multiple felony charges against him will not impact his timetable for a potential 2016 presidential run.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts