Fidelity Exploration and Production Company, the largest hydraulic fracturing (“fracking”) operator in southeastern Utah, has chosen Patrick O’Bryan to replace its outgoing CEO, Kent Wells.

Both executives have ties to the 2010 BP Deepwater Horizon explosion and subsequent oil disaster in the Gulf of Mexico, and both have links to BP‘s questionable accountability structure, poor safety record and overall bungled responses to the oil disasters.

O’Bryan was on the Deepwater Horizon rig on the day it exploded. His visit displaced key safety personnel that day, and delayed a key cement test that would have revealed faulty seals in the well.

In 2012, BP pled guilty to 14 criminal charges and agreed to pay $4.5 billion in fines and other penalties as a result of the disaster. In late 2014, the federal judge overseeing litigation involving BP, Carl Barbier, ruled that BP acted with “gross negligence” and was 67-percent at-fault for the Deepwater Horizon disaster that killed 11 workers and spilled as much as 4.9 million barrels of oil into the Gulf.

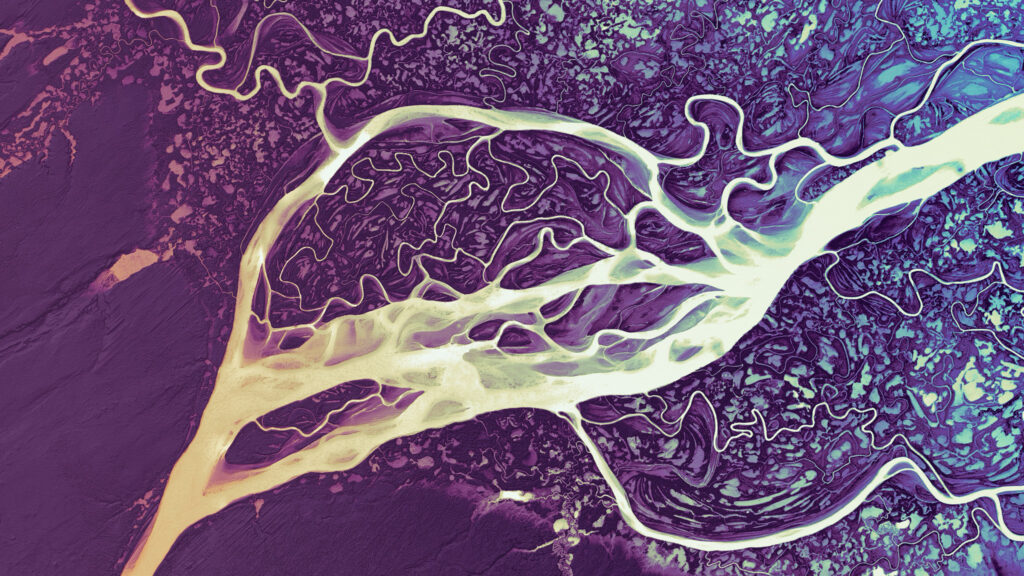

Fidelity Exploration is currently drilling near Moab, Utah, also known as “Red Rock Country.” Moab is home to Arches and Canyonlands National Parks and Dead Horse Point State Park. The area depends heavily on tourism, accounting for about 70 percent of jobs in the Moab area.

But the spectacular backcountry areas around Moab are currently under assault by drilling rigs. Moab residents and people coming to enjoy the area’s unique outdoor vistas complain about proliferating overland natural gas transmission pipe systems, noise, lights and flares from drilling rigs, the odor of fracking chemicals and greatly increased truck traffic on the area’s back roads due to drilling activities.

And what if Fidelity causes a spill? As O’Bryan’s track record with the Gulf shows, a once-treasured tourist destination could quickly transform into an industrial wasteland.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts