In a recent Washington Post editorial supporting oil industry efforts to lift the existing ban on exporting crude oil produced in America, the editors stated:

“The most serious objection to lifting the ban comes from environmentalists who worry that it would lower fossil fuel prices and lead to more oil consumption.”

And then they make the case that this is actually a positive as there may be some negotiations that result in support for “energy research funding, efficiency programs or, in an ideal world, a charge on carbon dioxide emissions to the package could balance its possible effects on the environment.”

In an ideal world, the climate wouldn’t be changing either. But we don’t live in an ideal world, do we? And the oil industry usually gets what it wants and environmental concerns go by the wayside regardless of who is in the White House. See arctic drilling permits for recent proof.

Existing Export Ban Limits Ability of Fracking Industry to Expand

The reality is that lifting the oil export ban will result in large increases in fracking for oil in the U.S.

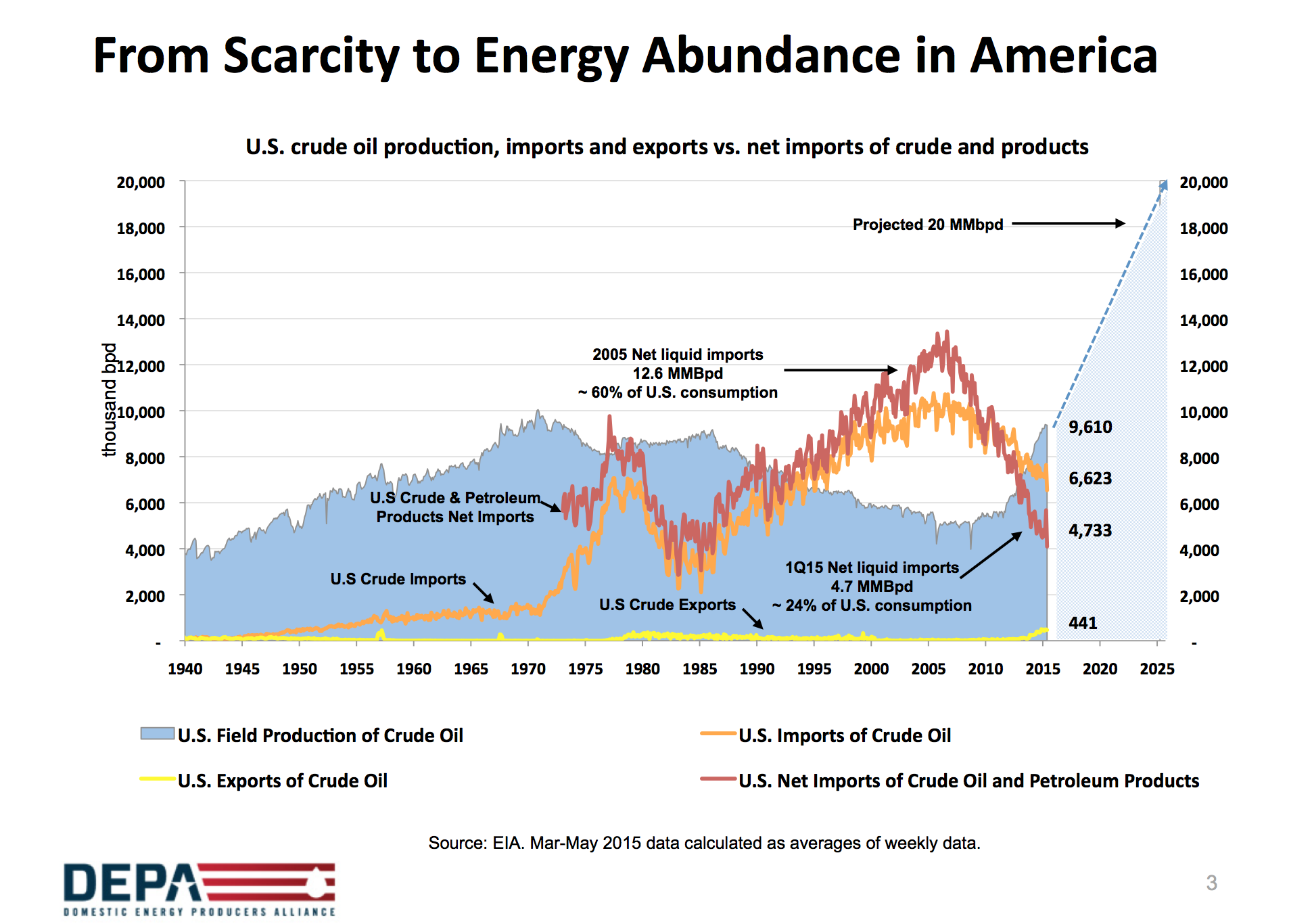

At the annual Energy Information Administration conference in Washington, D.C. in June, Harold Hamm, CEO of fracking giant Continental Resources, presented a slide that predicted oil production could reach 20 million barrels per day by 2025 if the crude export ban is repealed.

That is a massive increase over the existing amount of oil produced by fracking (aka “tight oil”) in the U.S. Tight oil current accounts for approximately half of the 9 million barrels a day of oil produced in the U.S. To get to Hamm’s predicted production levels that means a doubling or tripling of the scale of the current tight oil fracking industry.

And that means more flaring and more bomb trains because the industry hasn’t bothered to build the infrastructure to deal with the natural gas liquids produced by the current oil wells, so it is flared off or put in rail cars despite the danger.

Even the Government Accountability Office (GAO) report on lifting the export ban notes, “We found that crude oil development may pose certain inherent environmental and public health risks, however, the extent of the risk is unknown.”

As has been standard operating procedure for the fossil fuel industry, apparently the public will get to find out the “extent” of those risks once they have been exposed to them.

But for all that to happen, the export ban would have to be lifted so the oil can be sold to China and Europe or whichever market is the highest bidder.

So, as it stands, the export ban is essentially a ban on making it profitable to double or triple the fracked oil industry in America.

The Oil Industry is Just Looking Out for Itself, Not the American Consumer

As we’ve reported on DeSmog, the oil industry has lobbied heavily to have the export ban lifted. This has included funding studies and having the likes of Daniel Yergin pushing the idea in the pages of the New York Times and in talks at Columbia University and at the annual Super Bowl of Energy conference.

Additionally, oil giants ExxonMobil and ConocoPhillips have pushed the idea by arguing that lifting the oil export ban will lower gas prices in the U.S. In a recent congressional hearing on the subject, members of congress and those testifying repeatedly stressed the point that lifting the ban is “about the consumer.”

ConocoPhillips is running a widespread ad campaign including featured content articles with unintentionally honest headlines like, “Why Repealing the Oil Export Ban Will Fatten Our Wallets.”

This headline is quite accurate. ConocoPhillips stands to make billions in profits if the ban is lifted but the content of the article is a paid ad that actually argues how it will supposedly fatten every American’s wallet. That is far less likely.

There definitely are industry-funded studies that say lifting the ban will lower gas prices. And there is the GAO report that is based on these same industry-funded studies, as DeSmog reported when the report was released. The GAO report estimates the potential reduction in gas prices varying from 1.5 to 13 cents a gallon.

There is also the recent report from the Atlantic Council pushing to lift the export ban. Of course, the Atlantic Council receives funding from both China and Saudi Arabia so perhaps they aren’t interested in what is best for the American consumer?

And then there are other studies that say lifting the ban will increase prices.

In a rare bit of unvarnished truth on the issue, Michael Levi of the Council on Foreign Relations concluded that the impacts of potential U.S. crude exports on the global price of oil are greatly exaggerated.

Even the GAO report said that gasoline prices could go up in certain markets, like the Northeast, if the export ban was lifted.

So, while it certainly is possible that gas prices could go down if the export ban is lifted, they could also go up.

What isn’t possible is that global oil giants like ExxonMobil are motivated to help the American people.

Lee Raymond was CEO of ExxonMobil until 2005. According to Steve Coll’s book Private Empire, when Raymond was asked if ExxonMobil would build more refineries in the U.S. to help America he replied, “I’m not a U.S. company and I don’t make decisions based on what’s good for the U.S.”

Not surprisingly, that bit doesn’t make it into the ad campaigns.

Energy Security – Russia, Iran, Saudi Arabia and the Export Ban

The other angle the American public is being sold is that exporting U.S. oil will improve “energy security” because it will soften the influence of Russia and Iran on the global oil market.

But the people selling this idea already do business with Russia and they are poised to move back into Iran.

ExxonMobil owns more land in Russia than it does in the U.S. Bloomberg has reported that ExxonMobil has paid lobbyists to monitor the Iran negotiations and hopes to produce oil in Iran as well.

The Financial Times recently reported that one unnamed Western oil company executive described Iran as a potential “candy store” for global oil powers like ExxonMobil if the current Iran deal is approved.

So if ExxonMobil’s modus operandi is that it isn’t a U.S. company and doesn’t make decisions based on what is good for America — and is clearly making money off of oil production in Russia and Saudi Arabia and lining up to do the same in Iran — why does ExxonMobil have so much influence over U.S. foreign policy?

Perhaps because when it comes to campaign contributions, ExxonMobil and the oil industry are like an infinite candy store for politicians from both parties in the U.S.

Full Senate to Vote in September on Crude Oil Export Ban

The Senate Energy committee recently voted to lift the export ban. The full Senate is expected to vote on the bill in September, as politicians want to get it out of the way before a presidential election year. There will be much talk by politicians about how this will help the American consumer and improve energy security by challenging Russia and Iran.

Of course, none of this is true, but it sounds great.

Perhaps the only thing we do know for sure is that lifting the ban will vastly expand fracking for oil in the U.S. and continue to grow the world’s global dependence on fossil fuels. The GAO says that the risks this will pose are “unknown.”

However, if the export ban is lifted, by using this ‘wait and see’ approach to science, it will be easy to quantify those risks in a couple of decades. In the meantime, just enjoy your cheap gasoline and stop worrying so much. It isn’t an ideal world.

Photo credit: drowning politicians by Isaac Cordal

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts