The ongoing push to lift the ban on exports of U.S.-produced crude oil appears to be coming to a close, with Congress introducing a budget deal with a provision to end the decades-old embargo.

Just as the turn from 2014 to 2015 saw the Obama Administration allow oil condensate exports, it appears that history may repeat itself this year for crude oil. Industry lobbyists, a review of lobbying disclosure records by DeSmog reveals, have worked overtime to pressure Washington to end the 40-year export ban — which will create a global warming pollution spree.

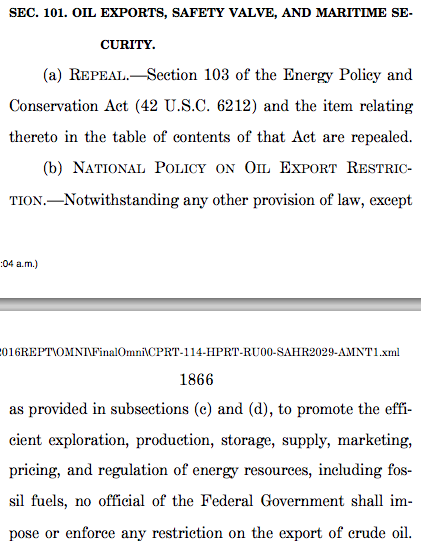

Image Credit: U.S. House of Representatives

Congress has introduced four oil export-promoting bills in the past year, all of which received heavy lobbying support from the industry. Language from those bills, as with a bill that opened up expedited hydraulic fracturing (“fracking”) permitting on public lands in the defense appropriations bill last year, is inserted into the broader budget bill.

So without further ado, meet some of the lobbying and big money interests that propelled these bills forward.

“Changing Crude Oil Market Conditions”

The push to repeal the oil export ban gained momentum throughout 2014 and culminated with the Obama Administration partially lifting the ban oil condensate. Before that partial repeal, a wholesale ban lift attempt ensued in Congress via H.R. 5814, clunkily named “To adapt to changing crude oil market conditions.”

H.R. 5814 mandated that the “United States should remove all restrictions on the export of crude oil, which will provide domestic economic benefits, enhanced energy security, and flexibility in foreign diplomacy.”

Companies such as Anadarko Petroleum, Marathon Oil and HollyFrontier Corporation all put their best foot forward in lobbying for the bill. Anadarko paid Robert Hickmott and W. Timothy Locke — both of whom passed through the government-industry revolving door — to do the job.

Take Two

Failing to pass in 2014, climate change denying U.S. Rep. Joe Barton (R-TX) re-introduced a bill by the same namesake as H.R. 5814 again in February 2015, now with a new bill number: H.R. 702.

From an oil and gas industry point of view, Barton was a fitting sponsor of the bills as someone who has taken close to $2 million in campaign contributions from the oil and gas industry throughout his political career. Barton also has $50,000-$100,000 in investments in fracking industry giant EOG Resources.

H.R. 702 passed with a 261-159 vote count in the U.S. House of Representatives in October but has yet to move through the U.S. Senate.

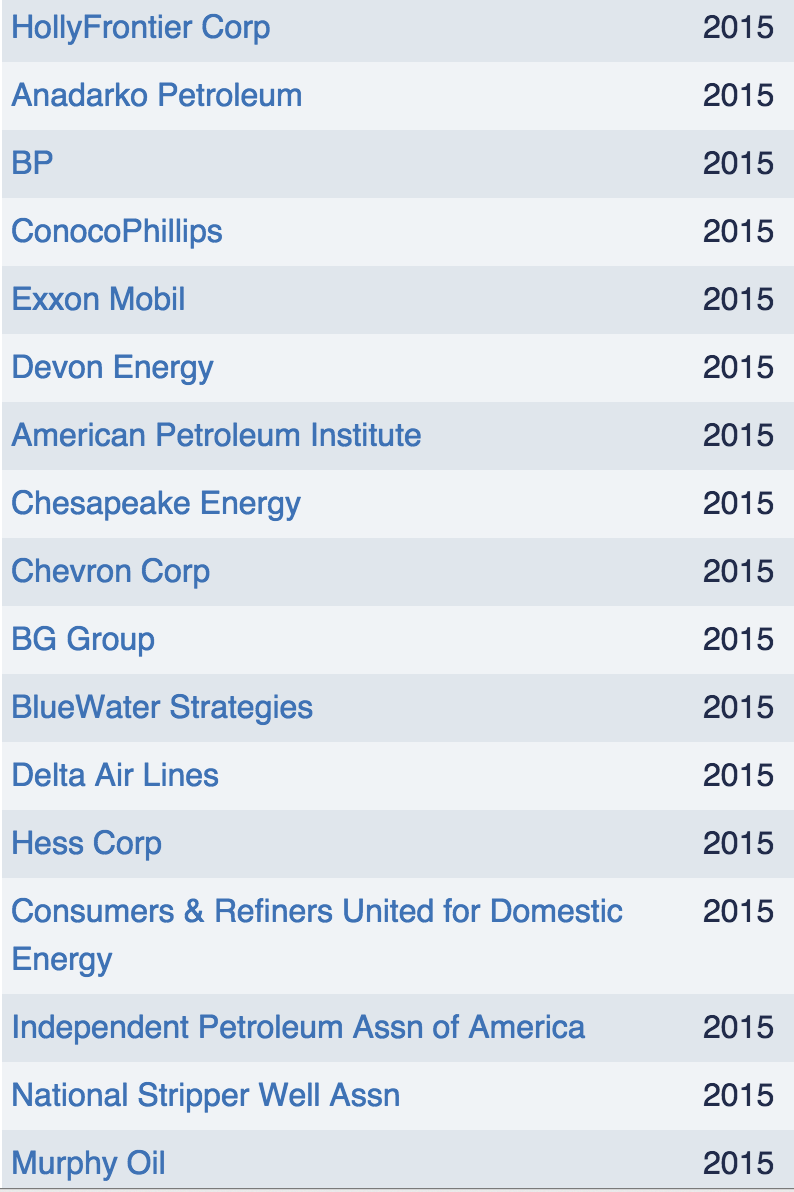

Far more companies lobbied for the bill this time around the block.

Image Credit: OpenSecrets.org

Among them is ExxonMobil, the news these days mostly for the “Exxon Knew” climate change denial scandal and the ongoing New York Attorney General’s Office investigation.

Exxon’s oil exports lobbyist armada includes former U.S. Senator Don Nickles (R-OK) and Majority Leader and U.S. Sen. Mitch McConnell (R-KY)’s former chief of staff Michael Solon.

The fracking lobby, America’s Natural Gas Alliance (ANGA), also brought its lobbying clout to the forefront for the bill. ANGA lobbied for H.R. 702 in both quarters two and three. National Industrial Sand Association, the frac sand industry’s lobbying group, also lobbied for the bill.

Koch Industries front group Americans for Prosperity (AFP) also deployed a trio of lobbyists to advocate on behalf of H.R. 702.

Crude Oil Export Act

Before Barton re-introduced “changing crude oil market conditions” in February, U.S. Rep. Michael McCaul (R-TX) used his first day on the job in 2015 on January 6 to introduce another related oil export ban repeal bill, Crude Oil Export Act (H.R. 156).

ExxonMobil again had a seat at the lobbying table pushing for this bill’s passage, as did Nickles and his lobbying group Nickles Group on the company’s behalf. Koch Industries also tossed its hat in the ring to lobby for the bill, as did ConocoPhillips, Chesapeake Energy, Shell Oil, BP and others.

The industry-funded and lobbyist-run think tank and advocacy apparatus Bipartisan Policy Center (BPC) also lobbied for the bill during quarter three via its lobbying and advocacy 501(c)(4) wing, the Bipartisan Policy Center Advocacy Network.

All of the lobbyists BPC deployed to push lifting the export ban, a DeSmog review has revealed, passed through the revolving door and formerly worked as congressional staffers.

Financial disclosure records show that the sponsor of H.R. 156, U.S. Rep. Michael McCaul (R-TX) has millions of dollars invested in oil and gas companies ranging from ExxonMobil, Chevron, Marathon Oil, EOG Resources, Schlumberger, Halliburton, Shell Oil, Dominion and others. Throughout his decade-long political career, McCaul has taken nearly $400,000 in campaign money from the oil and gas industry.

American Crude Oil Export Equality Act

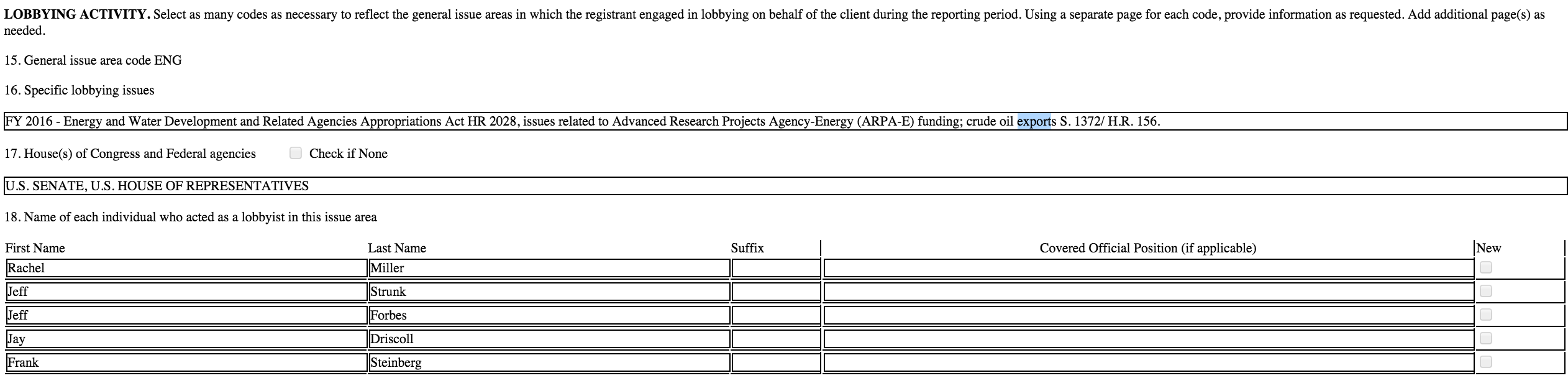

On the Senate side, in May U.S. Sen. Heidi Heitkamp introduced the latest iteration of an oil export ban repeal bill called the American Crude Oil Export Equality Act (S.1372). Though the bill has not gained much traction, it has not been without a valiant effort by the oil and gas industry, with the same familiar company names rearing their heads once again.

Image Credit: OpenSecrets.org

The lobbying list for S.1372 includes Koch Industries, the Bipartisan Policy Center, Marathon Oil, Devon Energy, ExxonMobil, ConocoPhillips, Shell Oil, BP, ANGA, the American Petroleum Institute and others.

Heitkamp bears similarities to other oil export ban lifting bill sponsors in that she also has taken large amounts of campaign contributions from the oil and gas industry throughout her political career. In her nascent two-year long political career as a U.S. Senator, Heitkamp has taken over $186,000 from the industry, her third biggest campaign contributor by category.

Refining Industry Big Money Flip

To date, the refining industry has situated itself as one of the most ardent opponents of oil exports besides the environmental community. That state of play changed, though, during the drafting stages of the budget bill.

Early on, news broke that a drafted proposed budget provision introduced by U.S. Sen. Tom Carper (D-DE) called for a trade-off between oil exports and subsidies going to oil refineries, otherwise known as a win-win for the oil and gas industry.

Carper, who devotes a portion of his website to the environment and climate change, is up for re-election in 2016 and one of his biggest donors so far is private equity firm giant Blackstone Group. Among many other oil and gas industry assets it finances, Blackstone serves as the financier of PBF Energy, the company that owns a massive Delaware City-based oil refinery.

Image Credit: OpenSecrets.org

An examination of Carper’s financial disclosure records shows he has upwards of $30,000 invested in refining giant Valero Energy — from whom PBF Energy bought a New Jersey-based refinery in 2010 — and upwards of $15,000 invested in BP (owner of the massive BP Whiting tar sands refinery in Whiting, Indiana).

“There are negotiations to make sure that the unintended consequences to dozens of refineries across the country are avoided,” Carper told The Hill on December 10. “The idea is that if the oil export ban is going to be lifted, we want to be sure there’s no collateral damage to refiners in this country.”

Environmental advocacy group Friends of the Earth took umbrage with Carper’s statement.

“Big Oil is already awash in billions worth of subsidies every year and Sen. Carper wants to send them even more,” Lukas Ross of FOE told Delaware’s News Journal. “Instead of pushing for extra goodies for his refining industry pals, Sen. Carper should oppose any climate-denying deal that would lift the crude oil export ban.”

Carper did not respond to DeSmog’s request for comment, but it appears his provision did not make it into the proposed budget bill. Instead, another pro-petroleum refinery provision made it into the budget, buried at the very end on pages 2008 and 2009.

Titled “Treatment of Transportation Costs of Independent Refiners,” the section offers a tax incentives for the transportation costs of getting petrochemical products to and from independent refineries in the U.S.

McKibben: “Hypocrisy”

In an opinion piece published by The Hill, 350.org founder and author Bill McKibben decried what he called the “hypocrisy” of the possibility of the signing of this bill, pointing out the post-Paris timing of it.

“If you were wondering how seriously world leaders took the obligations they imposed on themselves in Paris over the weekend, the early returns would indicate: not very,” wrote McKibben. “Barely 48 hours after all the back-patting at the climate conference had ended, word leaked out in Washington that the administration and Congress were preparing to lift the 40-year ban on oil exports, a major gift to the oil industry.”

Utilizing the #KeepTheBan hashtag on Twitter, groups such as the Center for Biological Diversity and Food and Water Watch are pushing for citizens to call the White House and congressional members and tell them not to lift the ban.

Photo Credit: Jirsak | Shutterstock

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts