On December 7, the Federal Energy Regulatory Commision (FERC) granted a 30-year license to Jordan Cove LNG (liquefied natural gas), located in Coos Bay, Oregon, to transform its existing import terminal license into an export terminal license. It would be the first LNG export terminal on the west coast of the U.S., with multiple LNG export terminals also in the negotiation phase, set to be located on the west coast in Kitimat, British Columbia.

KMTR–TV explains where the unconventional gas, procured via the toxic fracking process explained thoroughly in DeSmogBlog’s “Fracking the Future: How Unconventional Gas Threatens our Water, Health, and Climate,” will come from for Jordan Cove:

Construction of the Ruby Pipeline has brought gas from Wyoming to Southern Oregon, where it is sent to California. Construction of a new pipeline would link Ruby with Jordan Cove.

El Paso Natural Gas, a subsidiary of El Paso Corporation, owns the Ruby Pipeline. “Ruby is a 680-mile, 42-inch interstate natural gas pipeline,” according to its website.

The pipeline that KMTR–TV is referring to, which would link Ruby with Jordan Cove, is called the Pacific Connector Pipeline, and is proposed to be a “234-mile, 36-inch diameter pipeline,” according to its website.

Wyoming is home to the Niobrara Shale basin, which the Environmental Protection Agency recently revealed as a site of groundwater contamination linked to the fracking process.

LNG from Jordan Cove LNG will be exported to the Asian market, which is willing to pay three times more for the fracked gas than the domestic market. In a September interview with the business journal Platts, Jordan Cove LNG project manager Robert Braddock stated the rationale behind converting Jordan Cove into an export terminal: “we would have certainly much closer access to the Asian markets.”

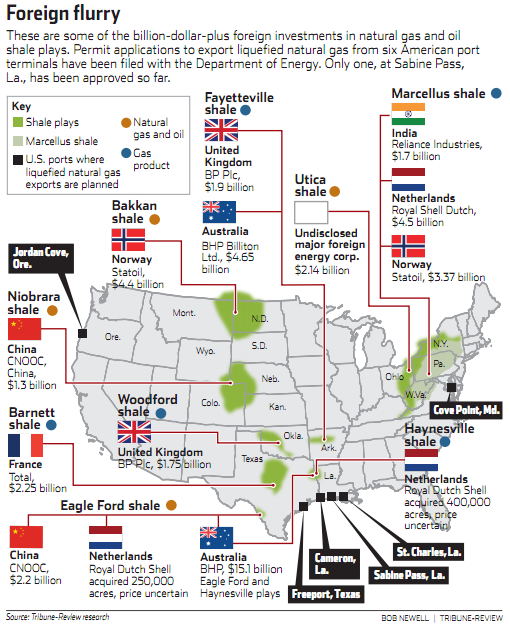

This is but a small piece of a much bigger, broader picture of foreign-based multinational corporations investing in U.S. shale operations in order to benefit from the export potential. This will mean higher prices for U.S. consumers, despite industry claims to champion U.S. energy independence and “affordable” energy.

A Foreign Flurry to Profit from U.S.-Based Shale Gas

Two important investigative reports on the subject came out recently, one by Food and Water Watch and another by the Pittsburgh Tribune-Review. Both of the reports show that, contrary to the claims made by the oil and gas industry that fracking for unconventional energy will “boost local economies,” fracking is increasingly revealing itself as a boon for huge multinational corporations, often not even based in North America, but in foreign locales.

“Foreign investment poured into American gas and oil shale fields through three quarters of 2011, amounting to $24.5 billion of the total $39.9 billion in deals,” revealed the Tribune-Review.

Furthermore, as DeSmogBlog previously revealed, the Federal Energy Regulatory Commission (FERC) has approved two LNG export deals, both in Sabine Pass, Texas, with many many more FERC deals in the middle of the approval process.

The map below, produced by the Tribune-Review, best portrays who stands to gain from the North American fracking boom happening in every crevice of the United States. “Boosting the local economy”? As can be seen quite clearly, this is merely a pipe dream.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts