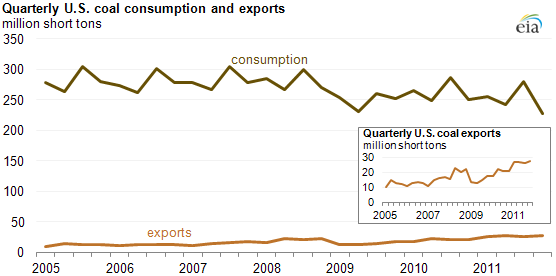

U.S. coal companies are facing some tricky math these days. Production levels have remained more or less the same since 2005, according to the Energy Information Agency (EIA), but during that time domestic consumption has dropped nearly 11 percent.

Where is all that extra coal going? Some is piling up at power plants, but increasingly, more and more of it is being shipped overseas.

The coal industry is hoping to accelerate that export trend, but their ability to keep delivering steady volumes of coal is entirely dependant on their ability to open up new export terminals at coastal ports around the country, particularly in the Pacific Northwest where the dirty rock could be more directly shipped to the burgeoning Asian markets.

Still, aside from some regional coverage and some incredible work from organizations like the Sightline Institute and Climate Solutions, these Northwest export terminals aren’t getting nearly the amount of attention from environmentalists and climate activists as, say, tar sands pipelines.

This post will serve as a basic overview of the current state of coal production and exports, and what the industry hopes to accomplish in coming years.

Coal producers’ woes

American coal consumption is steadily decreasing, and particularly weak demand this year is wreaking havoc on the industry. As this Wall Street Journal article from Sunday describes, major producers like Arch Coal and Alpha Natural Resources are taking major hits to their profit numbers, and shares of both companies are down 72 percent in the past year. Those types of numbers make shareholders anxious and CEOs panic.

Even worse (for the mining companies), weak demand “has caused coal inventories to pile up at utilities to the point where some are delaying contracted deliveries.”

Of course, it’s not all piling up at power plants. More and more coal is being exported every year.

Arch, Alpha and the rest of the industry hope that increased coal demand from fast-growing China and India will help turn the tide. But that poses additional problems. U.S. companies are scrambling to increase their access to ports in the Gulf Coast and East Coast to ship coal abroad.

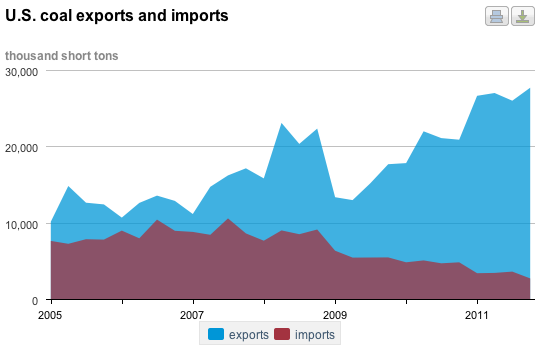

By the numbers, coal exports are way up in recent years, but there’s only so much coal you can move through a crowded, busy port. It’s reasonable to assume that these export numbers will level off unless the companies are able to open up more export terminals.

Coal exports now

According to EIA’s Quarterly Coal report, about 107 million tons of coal (107,258,561 short tons, to be exact) were exported in 2011. That’s up from roughly 82 million tons in 2010 – a 31.3 percent increase.

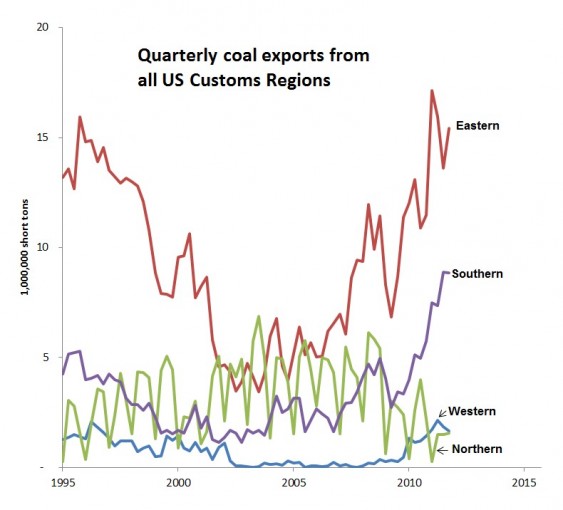

As you can see from this Sightline Institute graph, the vast majority of this coal was shipped from ports in the East and the South.

No surprise, then, that the vast majority of that coal was sold to Europe and countries in North and South America. Shipments to Asia represent barely one-quarter of all American coal exports, or roughly 27 million tons per year. (That number itself is way up from just a few million tons up through 2009.)

Meanwhile, production in the Powder River Basin of Montana and Wyoming is booming, and there’s currently no practical way to ship coal from the Northwest across the Pacific Ocean without going through Canada. **UPDATE: Read Steve Horn’s blog about the planned protest this Saturday to stop the BNSF coal trains.**

Northwest export plans

While mining companies are now able to ship Powder River Basin coal through ports in British Columbia (though they struggle to compete in those venues with higher value Canadian coal), and are working to expand those terminals, the proposals for port towns in Washington and Oregon have the potential to dramatically increase exports to Asia.

Once again, Eric de Place at the Sightline Institute has done exhaustive research on the current state of these proposals. Rather than duplicate his effort, I’ll share the descriptions from a Coal Exports FAQ report that Sightline put out last month. (It’s well worth downloading the entire report, by the way.)

- Cherry Point, Washington. SSA Marine is planning to build and operate the Gateway Pacific Terminal, a new shipping facility north of Bellingham that would be capable of handling 48 million tons of coal per year. Peabody Energy, the world’s largest private sector coal company, has already agreed to supply 24 million tons of coal.

- Longview, Washington. Millennium Bulk Terminals, a subsidiary of the Australian coal mining company Ambre Energy, purchased a port site on the Columbia River. Arch Coal, a major American coal mining company, has a 38 percent stake in the site. Ambre hopes to export 44 million tons of coal, with 25 million tons in the first phase.

- Grays Harbor, Washington. According to newspaper accounts, RailAmerica is planning to develop a coal export terminal at the Port of Grays Harbor’s Marine Terminal 3 that could handle 5 million tons of coal each year.

- Port Westward, Oregon. Kinder Morgan is planning to build and operate a coal export terminal at the Port Westward Industrial Park near Clatskanie that will be capable of handling 30 million tons of coal per year, with 15 million tons in an initial phase of development.**See update below**

- Port of Morrow, Oregon. Ambre Energy is planning to construct a facility on the Columbia River in eastern Oregon that will transfer coal from rail to barges that will be towed downriver Port Westward where the coal will be loaded on ongoing vessels. The company says that the system will be capable of handling 8 million tons per year.

- Coos Bay, Oregon. The Port of Coos Bay is considering a mysterious proposal known only as “Project Mainstay” that officials say could export 6 to 10 million tons of coal per year.

If each of these facilities were to operate at full capacity, Northwest ports would be shipping more than 140 million tons of coal each year, making it one of the largest coal-shipping regions in the world.

Remember, in 2011 the U.S. exported about 107 million tons total, so these six terminals have the potential to more than double American coal exports.

Last week I wrote about the Port of Morrow proposal, and I’ll update this list with links to any future coverage as those stories develop.

Update: Also check out Grist’s David Roberts’ recent post on coal exports, a great read.

**Portland General Electric this week rejected an initial proposal for a coal export terminal at the Port of St. Helens, citing the threat that coal dust could foul the air used for combustion in its two natural gas plants nearby.**

Photo: Paul K. Anderson, via CoalTrainFacts.org

Graphs (except Sightline, as labeled): U.S. Energy Information Administration, Quarterly Coal Report.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts