But there are other benefactors that are worth a closer look, as nobody stands to benefit as much in the longer term (if the Keystone XL pipeline is ever built) as the companies that operate the refineries on the Gulf Coast.

Let’s step back and review what the refineries actually do. The diluted tar sands bitumen (or “DilBit”) that would flow through Keystone XL is an ultra-acidic, highly viscous mess, that doesn’t at all resemble the refined petroleum products like diesel or gasoline or even jet fuel that are sold on the commercial markets. DilBit is, in the words of Keith Schneider, ”thick as peanut butter and more acidic, highly corrosive, and abrasive” than typical crude.

This tar sands DilBit needs to be refined before it can be sold. But only certain refineries are capable of handling the corrosive DilBit.

Refiners along the Texas Gulf Coast, where the Keystone XL pipeline would ultimately deliver tar sands DilBit from Canada, are eager to accomodate. The company that appears positioned to receive and refine more of TransCanada’s crude than anyone else is the Valero Energy Corporation (NYSE: VLO).

Valero “Dedicated” To Keystone XL – And Ready To Profit From It

Valero is the world’s largest independent refiner, with 15 refineries that have a collective capacity to process 2.9 million barrels per day. While their commitments to TransCanada are confidential, Valero is publicly “dedicated” to the Keystone XL project, and their 310,000 barrels per day Port Arthur, Texas refinery would receive the Alberta-born crude. Valero has invested heavily to upgrade the Port Arthur plant to handle “heavy” “sour” crude (a.k.a. tar sands DilBit) for the past few years, anticipating the pipeline’s completion.

The company has long hoped for a steady supply of Alberta’s tar sands crude, first signing on to Keystone in July of 2008. In 2010, when the Texas company was pouring money into California’s Prop 23 battle, spokesperson Bill Day urged that Alberta is “a tremendous potential supplier for us.”

While their involvement with Keystone XL has largely flown under the radar, Valero was exposed in the bombshell “Exporting Energy Security: Keystone XL Exposed” (PDF) report by Oil Change International in September. The report found that, despite constant claims by TransCanada and other Keystone supporters of increased “energy security,” much of the crude that flows through Keystone XL would be exported. Valero was held up as a prime example of how and why. From that report:

Shell’s subsidiary Motiva and Total, both “shippers” with long-term contracts with TransCanada, also operate in this Foreign Trade Zone, meaning that they are exempt from customs duties on imports and exports, and also from state and local taxes.

In other words: they can sell the Keystone XL crude overseas without paying American taxes. Combine that with the fact that the Port Arthur plants are conditioned to take low-grade tar sands crude and refine it to diesel–which has much higher demand overseas– and the incentive for Valero to export the Keystone XL crude is huge.

The Oil Change International report caused quite the stir, and put Valero on the defensive. Company spokesperson Bill Day told Platts EnergyWeek that “the vast majority of products that Valero makes in the US are sold in the US…As far as I know, we’ve never said anything about exporting products to China, nor do we have plans to.”

On China, Day was referring to a statement by Sierra Club president Michael Brune, which was technically inaccurate. Despite Brune’s error, Valero’s overall export strategy is clear and obvious to anyone who takes the time to read their September report to investors.

Here are two telling slides.

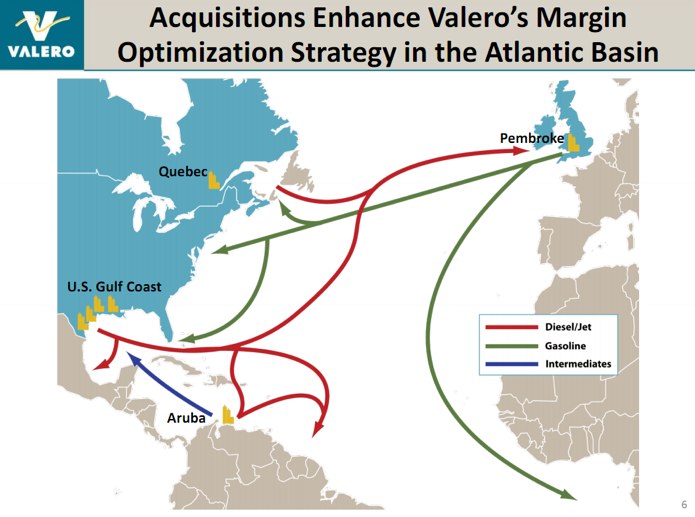

This map shows clearly the company’s strategy to export diesel from the Gulf Coast refineries (like Port Arthur) to European, Mexican, and South American markets, while importing gasoline from overseas.

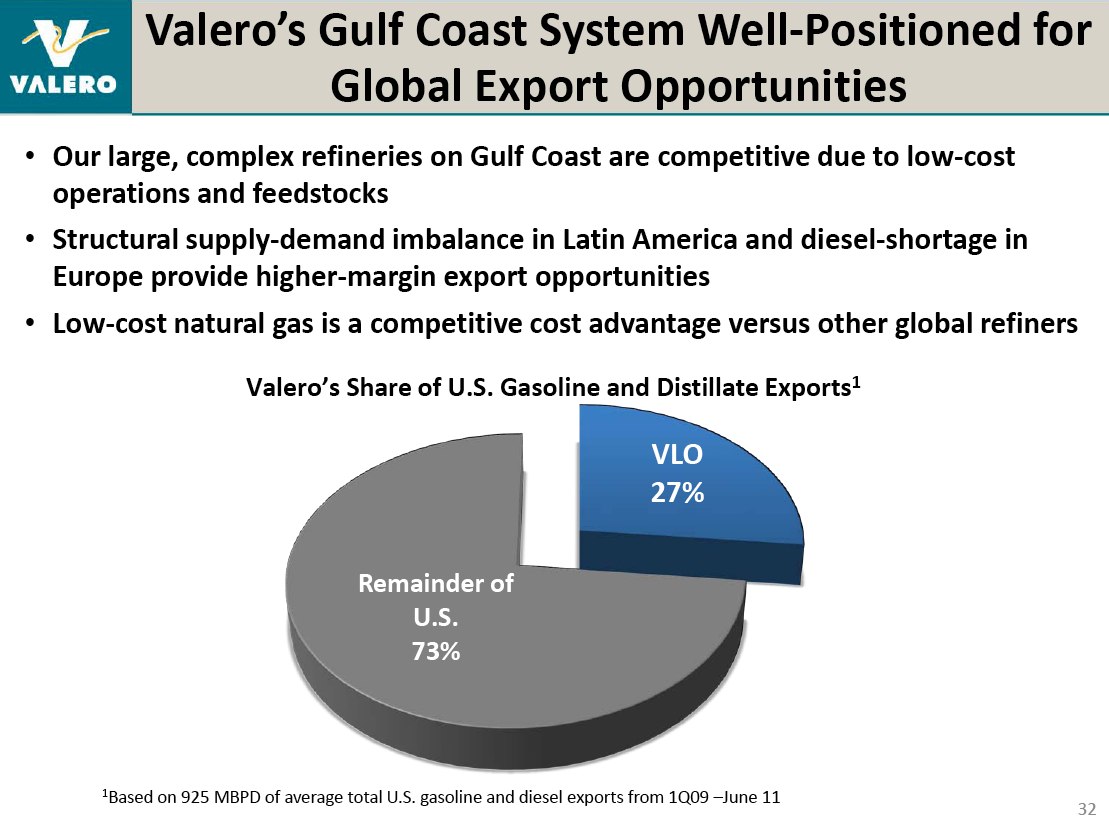

And here is a slide showing explicitly Valero’s plans to export diesel to the strong European market.

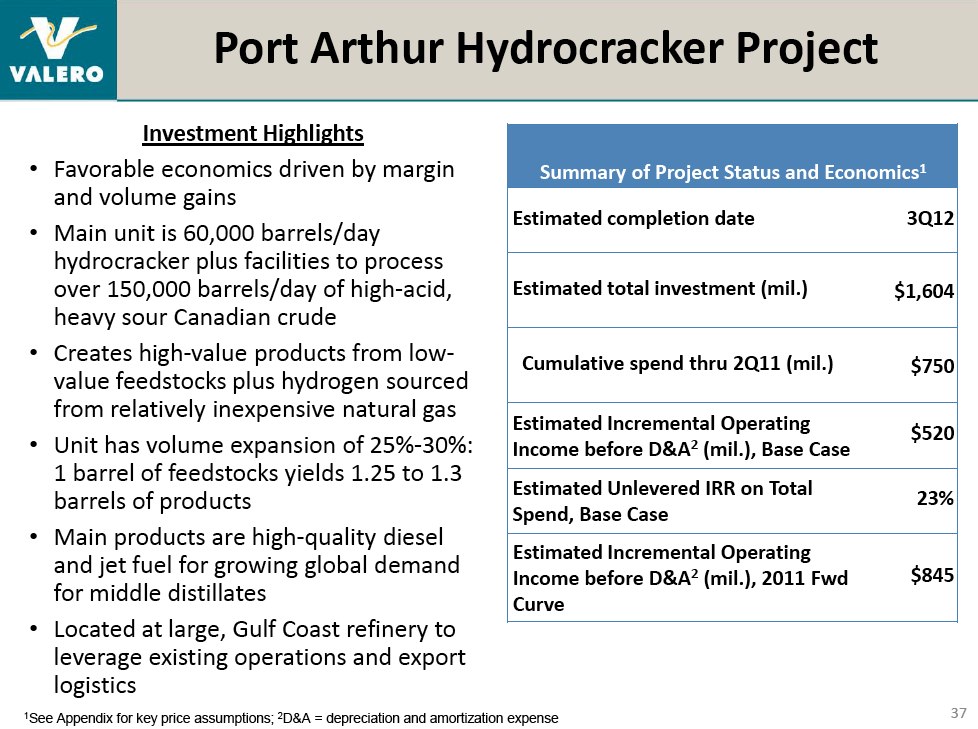

Finally, here’s their slide on the Port Arthur plant, which is ready “to process over 150,000 barrels/day of high-acid, heavy sour Canadian crude,” and which produces “high-quality diesel and jet fuel for growing global demand for middle distillates, and is “located at large, Gulf Coast refinery to leverage existing operations and export logistics.” (Emphasis mine.)

If there’s any doubt that Valero intends on exporting the tar sands crude that Keystone XL delivers, this investor presentation should put that to rest.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts