Right before the champagne bottles began popping for activists engaged in a grassroots struggle to halt the construction of Williams Companies‘ prospective Bluegrass Pipeline project — which the company suspended indefinitely in an April 28 press release — Williams had already begun raining on the parade.

The pipeline industry giant took out the trash on Friday, April 25, announcing its intentions to open a new Louisiana pipeline named Gulf Trace.

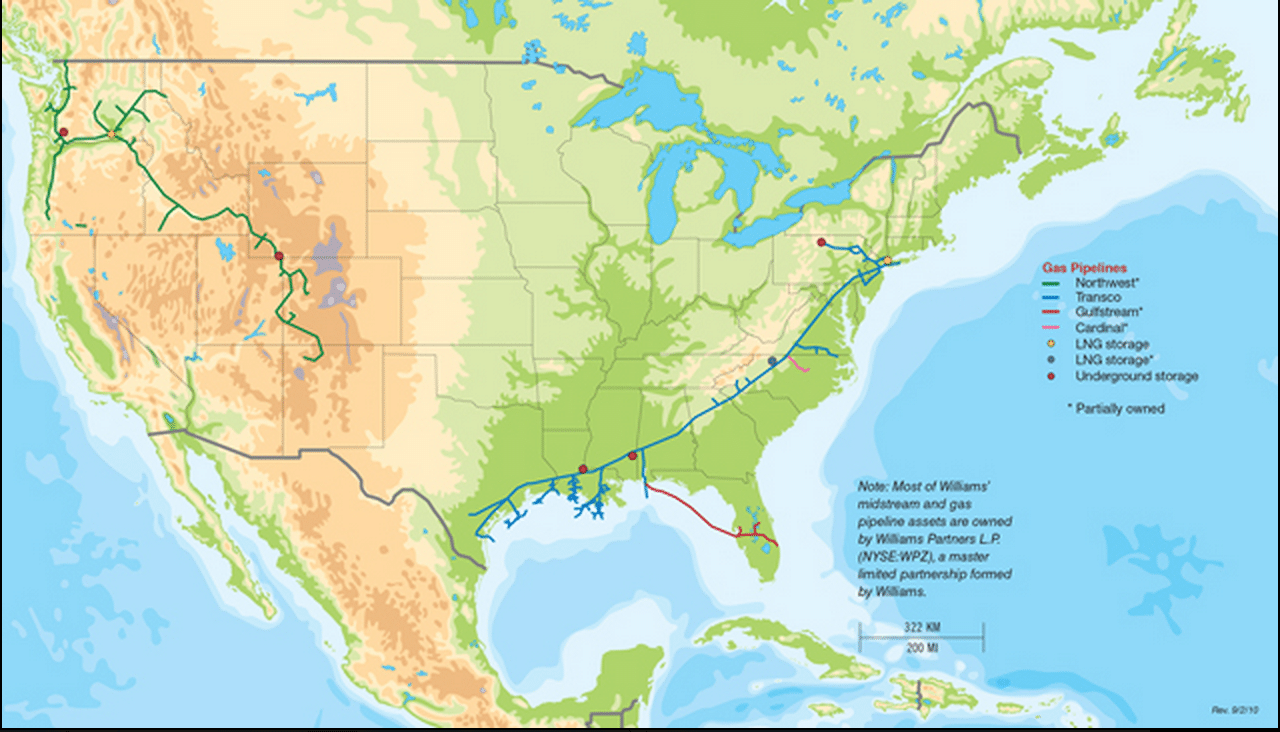

Akin to TransCanada’s ANR Pipeline recently reported on by DeSmogBlog, Gulf Trace is not entirely “new,” per se. Rather, it’s the retooling of a pipeline system already in place, in this case Williams’ Transco Pipeline system.

The retooling has taken place in the aftermath of Cheniere’s Sabine Pass LNG export facility receiving the first ever final gas export permit from the U.S. Federal Energy Regulatory Commission (FERC) during the fracking era.

Williams’ Transco Pipeline System; Photo Credit: William Huston

Both ANR and Gulf Trace will feed into Sabine Pass, the Louisiana-based LNG export terminal set to open for business in late 2015. Also like ANR, Transco will transform into a gas pipeline flowing in both directions, “bidirectional” in industry lingo.

Bluegrass, if ever built, also would transport fracked gas to the Gulf Coast export markets. But instead of LNG, Bluegrass is a natural gas liquids pipeline (NGL).

“The project…is designed to connect [NGLs] produced in the Marcellus-Utica areas in the U.S. Northeast with domestic and export markets in the U.S. Gulf Coast,” it explained in an April 28 press release announcing the project’s suspension.

With Bluegrass tossed to the side for now, Williams already announced in a press release that the company has launched an open season to examine industry interest in Gulf Trace. It closes on May 8, 2014.

“Although we recognized the suspension of the Bluegrass could impact non-conventional drilling here in Western Pennsylvania, we should all know better than to get too excited about this announcement,” Carrie Hahn, a Pennsylvania-based activist told DeSmogBlog. “There is too much at stake here for them to give up that easily.”

The announcement follows in the aftermath of the flurry of federal-level lobbying activity by Williams during the first quarter of 2014.

Williams Spends Big Lobbying for Exports

First-quarter lobbying disclosure forms indicate Williams spent $450,000 lobbying at the federal level for both shale gas exports and pipeline permitting issues. It has done so utilizing both its in-house lobbyists and outside lobbying firms.

In-House Lobbyists

In-house, Williams spent $410,000 on its own to advocate for gas exports and pipeline permitting issues during the first quarter. Williams’ lobbying efforts were headed by its vice president for governmental affairs, Deborah Lawrence and director of governmental affairs, Glenn Jackson.

Outside Lobbying Firms

No smart corporation makes a big announcement of this sort without first greasing the skids and Williams is no different in that regard, utilizing the age-old government-industry revolving door to curry favor.

In that vein, meet Ryan, MacKinnon, Vasapoli and Berzok, LLP, which Williams paid $40,000 to lobby on its behalf during the first quarter.

Lobbyist Thomas Ryan formerly served as chief counsel for the U.S. House Energy & Commerce Committee. That committee has pushed forward shale gas exports in a big way so far in 2014. Ryan is one of the lobbyists listed on the firm’s first-quarter disclosure form on the Williams file.

Jeffrey MacKinnon, another lobbyist listed on the firm’s lobbying disclosure form, also has close ties to the Energy & Commerce Committee. MacKinnon formerly served as legislative director for U.S. Rep. Joe Barton (R-TX), the climate change denier and former chairman of the Energy & Commerce Committee.

U.S. Rep. Joe Barton: Photo Credit: Wikimedia Commons

Add Joseph Vasapoli to the list, as well.

Vasapoli, who helped write the Energy Policy Act of 2005 that transformed fracking into a widespread practice in the U.S., formerly served as Republican Counsel for the Energy & Commerce Committee. He also has spent time working at both FERC and the U.S. Department of Energy (DOE), the two federal agencies responsible for overseeing the LNG export permit process.

The other three lobbyists listed on Ryan, MacKinnon, Vasapoli and Berzok, LLP‘s disclosure form for the work it did on behalf of Williams — Matthew Berzok, Nick Kolovos and Jeffrey Mortier — also passed through the revolving door as former staffers for congressional members who were on the Energy & Commerce Committee.

“Empire State of Mind:” New York Connection

Burgos and Associates, also registered to lobby on behalf of Williams at the federal level, is a New York City-based firm at the center of a February 2013 investigation published on DeSmogBlog on the New York Fracking Scandal.

The episode earned the unflattering name because New York Governor Andrew Cuomo, who has the final say over whether the floodgates will be opened for fracking the Marcellus Shale in his state, has a powerful aide named Larry Schwartz.

Schwartz, DeSmog revealed, has thousands of dollars worth of investments in Williams Companies and other companies standing to gain if fracking goes forward in New York.

And in New York, like at the federal level, Burgos and Associates lobbies on behalf of Williams.

Not coincidentally, the powerful Tonio Burgos owns Burgos and Associates and is the former aide to Andrew Cuomo’s father, Gov. Mario Cuomo.

Burgos was described by the Chicago Tribune in a 1993 article as Mario Cuomo’s “patronage chief.” He was also identified in 2012 by The Wall Street Journal as “one of [Andrew] Cuomo’s closest outside advisers and top fund-raisers.”

A reminder: Williams’ Transco runs from New York and the northeast down to the Gulf.

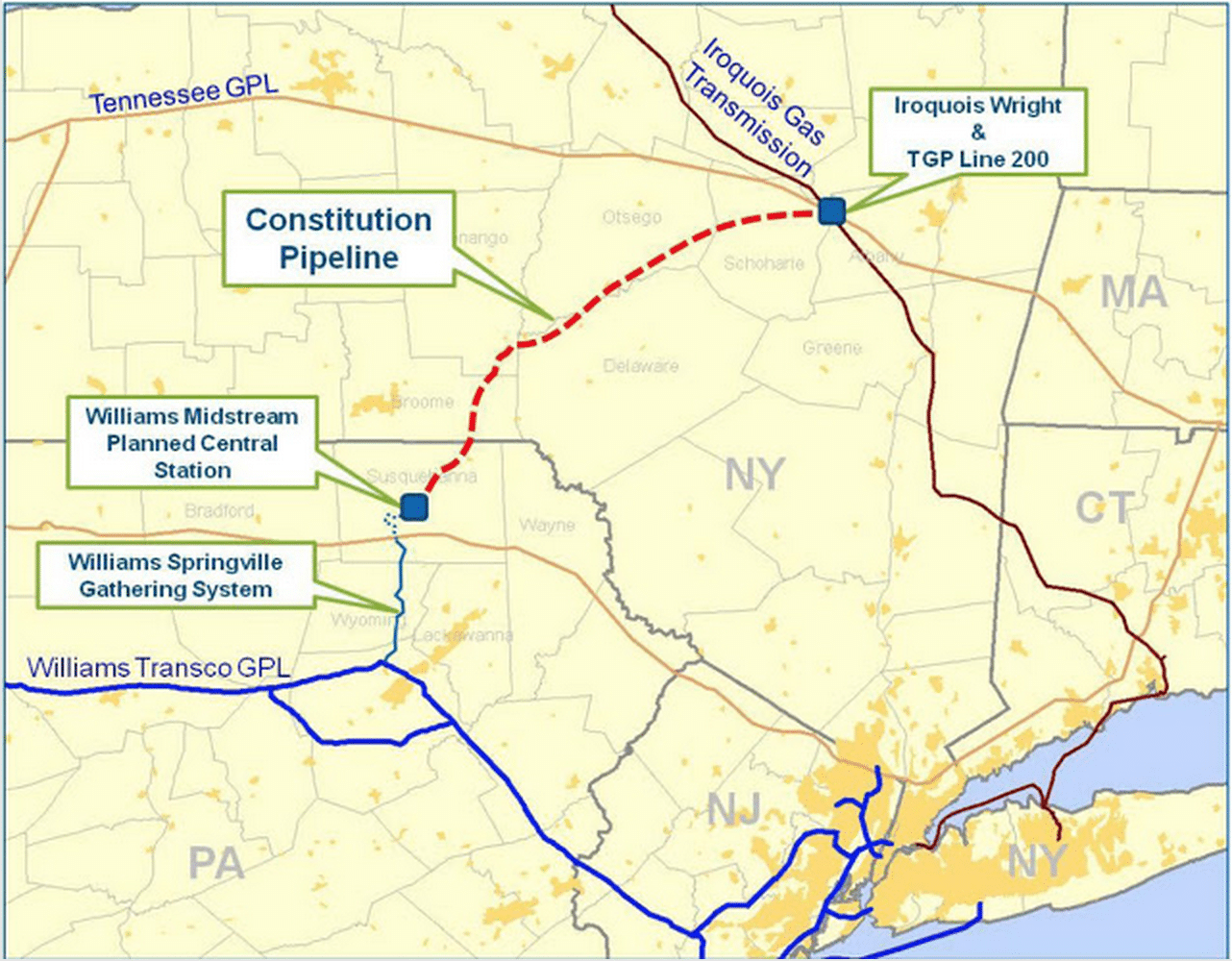

Transco is connected to fracked gas produced in Marcellus Shale via the company’s Springville Pipeline and its proposed Constitution Pipeline, which is set to connect to Springville when if and when it opens for business in 2015 or 2016.

Williams’ Constiution Pipeline and Springville Pipeline; Photo Credit: William Huston

In short, New York — a state geographically distant from Louisiana, Gulf Trace and Sabine Pass LNG —is directly connected to Williams’ latest export pipeline announcement both via its lobbyists and Williams’ gas pipeline empire.

And so while fracking has yet to commence in the Empire State, that doesn’t mean the shale gas industry doesn’t have an increasingly heavy footprint there, as it proceeds with business as usual by using an “empire state of mind.”

Photo Credit: Shutterstock | Oleksandr Kalinichenko

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts