This is a guest post by Stacy Clark that originally appeared in The Citizen.

Reading Harvard Crimson Staff Writer Matthew Q. Clarida’s headline in September, “School of Public Health Renamed with $350 Million Gift, Largest in Harvard History” immediately caught my attention. It wasn’t the remarkable size of the gift as much as it was the exact amount.

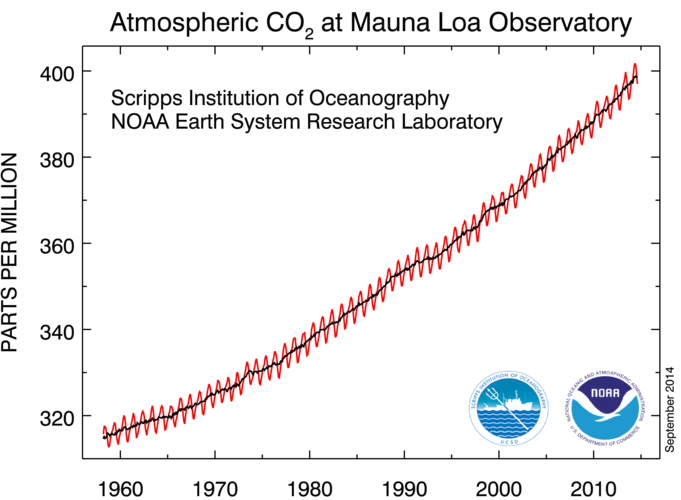

Seeing the words “350 Million” and “Public Health” caused me to wonder if this pledge marked the beginning of a new era at Harvard. Was this the donation that would change everything? Maybe it was inspired by a collegial relationship with Harvard graduate Bill McKibben, whose global 350.org organization advocates for limiting atmospheric concentrations of carbon dioxide (CO2) to 350 parts per million (ppm) to avoid the most egregious consequences of global climate disruption.

The timing for a $350 million pledge was orchestrated perfectly, I concluded, as the United Nations Secretary-General Ban Ki-moon was soon to welcome world leaders to Manhattan the week of September 22nd to seek common ground on how to achieve 350’s goal.

As it turns out, Clarida’s reference to “350 Million” did not correlate directly to the critical intersection between climate, energy, and public health.

Then, two days later, on September 10, another Crimson headline caught my eye.

The story, by Forrest K. Lewis, announced a $3.50 million pledge to Harvard’s Kennedy School of Government to support the education of future environmental leaders. On September 12th, when the story was updated to include the following statement, I couldn’t help but think that this $3.50 million gift by Louis M. Bacon may carry an intentional symbolic message:

“Bacon credited a reliance on the future generation of public leaders in saving the environment as motivation for his donation.”

Might Harvard’s leaders, inspired by Bacon’s goal, and aware of 350’s urgent call to lower CO2 emissions, agree to review the environmental integrity of its endowment and reconsider their decision not to divest from fossil fuels?

Having decided to become an environmental geologist following a 1982 Harvard internship, where I researched and reported on the contamination of public drinking water wells in Woburn, MA, and now with my son attending the college, I’m eager to see Harvard evolve their thinking concerning the management of their endowment to include an awareness of its environmental implications.

Here’s Why:

- Fossil fuel companies fund climate science denial and obstruct clean energy innovation through direct lobbying, payments to conservative think tanks and, increasingly, through intentionally secretive, third party “pass-through foundations,” where contributions remain untraceable and invisible to the public.

- At least $2.0 billion has been spent over 15 years by the fossil fuel industry to mislead the public on the causes of global climate disruption, while during the same 15 years, CO2 emissions from fossil fuel combustion literally skyrocketed from 370 ppm to 400 ppm.

Image Credit: National Oceanic and Atmospheric Administration (NOAA)

- The urgency and attention that Nobel Prize winning scientists at Harvard and elsewhere have brought to the understanding of global climate disruption causes and consequences has for over 15 years been ignored, rebuffed, ridiculed, suppressed, and even silenced by the fossil fuel industry. By placing profits so far ahead of people, the fossil fuel industry has pushed the world to and beyond its physical, chemical, and biological capacity to adapt and rebound to ever-increasing concentrations of heat-trapping CO2.

- Exxon Mobil’s $1.4M donations to the American Legislative Exchange Council (ALEC) funds campaigns to roll back renewable energy portfolio standards and the expansion of net metering programs into states like Texas (the country’s largest carbon polluter), where abundant sunshine should already be producing large blocks of emissions-free electricity to its rapidly growing population. It’s the interference—overt and subversive—of the fossil fuel industry that is undermining the expansion of clean energy when we need it the most.

Perhaps familiarity with the profits of the clean energy sector will help to accelerate the University’s embrace of fossil fuel divestment from at least an economic perspective.

The fact is that over the past two years the growth of many clean energy businesses equaling or exceeding those of fossil fuel companies could have and should have become a dynamic part of Harvard’s energy investments.

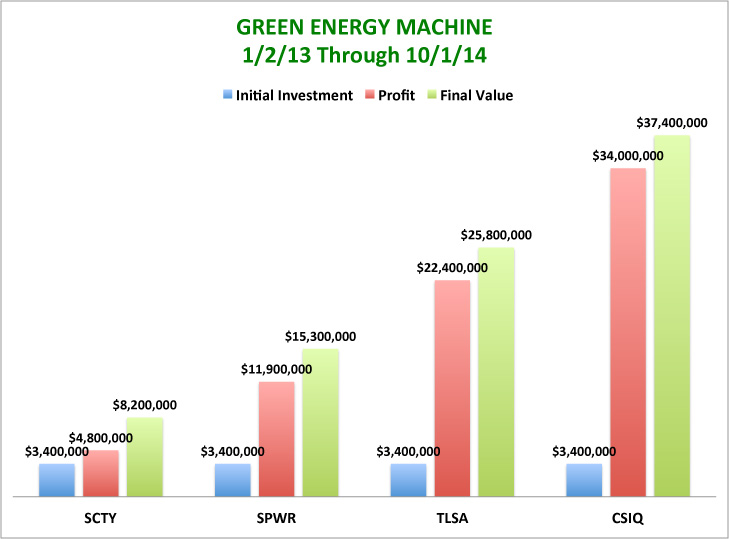

A February 2014 Huffington Post article showcased the annual gains of four of 2013’s top performing clean energy stocks. They were: Solar City (SCTY) 343%; Sun Power (SPWR) 359%; Tesla (TSLA) 404%; and Canadian Solar (CSIQ) 921%.

In the story, the author calculated that by shifting just 10% of its roughly $34M stake in the fossil fuel industry to any one of these businesses in January 2013, Harvard would have enjoyed great gains.

Looking at these same four stocks over a longer period of 21 months (January 2, 2013 to October 1, 2014), one sees that they continue to perform well. SCTY grew 144%; SPWR grew 350%; TSLA grew by 660% and CSIQ grew 1000%.

If Harvard had divested just 10% of its holdings in the fossil fuel industry and reinvested the same amount in any one of these businesses, the gains over 21 months would be: SCTY $4.8M; SPWR $11.9M; TSLA $22.4M; CSIQ: $34M

Divesting by just 10% to reinvest in CSIQ would have doubled the value of Harvard’s energy holdings to over $60M and would have divided it nearly equally between traditional energy and clean energy. What a coup. A $3.4 million investment in the right stock could change everything. At least it would be a start.

By divesting from fossil fuels and charting an economic course for sustainable growth, Harvard’s endowment will benefit from the profits of clean energy, which unlike fossil fuels, are socially and environmentally defendable to the overwhelming majority of Harvard students who already support divestment. Letting go of polluting assets that threaten human health and the environment actually invites scalable breakthroughs in clean tech manufacturing and financing that may well be the antidote to a world climate spinning rapidly out of control. After all, what’s the value of a $36B endowment to a planet that has sputtered and stalled?

I hope that one morning soon, as the sun is rising, and the winds are brisk, I’ll come upon another Crimson headline that reads something like this:

“Harvard Announces Fossil Fuel Divestment Owing to the Opportunity of the Clean Power Sector and 350.org’s Urgent Call for Renewable Energy Deployment.”

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts