Asked for his take on President-elect Donald Trump’s appointment of Oklahoma Attorney General Scott Pruitt to head the U.S. Environmental Protection Agency (EPA), multi-billionaire investor and Trump business partner Carl Icahn told Bloomberg that Pruitt is “going to really be a breath of fresh air.” Given Icahn’s business ties, that statement is steeped in accidental irony.

Icahn, owner of the holding company Icahn Enterprises and a major donor to Trump’s presidential campaign, was instrumental in choosing Pruitt — a man who as state prosecutor actively opposed most federal environmental regulations and denied the science of climate change — for the nation’s top environmental job. As reported by The Wall Street Journal, Trump allowed Icahn, the 26th most wealthy man on the planet, to vet and interview finalists for high-level EPA jobs even though Icahn owns business assets impacted by current EPA regulations.

In addition, a DeSmog investigation shows that Icahn Enterprises owns oil industry assets based in Oklahoma, which are involved in EPA enforcement violations, and does business with TransCanada’s Keystone pipeline system.

EPA “Run Amok”

In his interview with Bloomberg, Icahn made clear his lack of affinity toward the EPA and environmental regulations.

“The EPA, in my opinion, has gone way too far, has sort of run amok with these crazy regulations,” Icahn said. “I’ve spoken to Scott Pruitt I’d say four or five times and gotten to know him and I really think he’s a great pick.”

Pruitt, he told Bloomberg, “feels pretty strongly about the absurdity of these obligations,” and Pruitt believes that “it’s very bad in this country to have more than several good refineries on the brink of disaster and the brink of bankruptcy, which the EPA has made to come about.”

Keystone XL, Koch Connection

It turns out that one of those refineries Icahn was referring to is actually owned by his holding company and based in Pruitt’s home state of Oklahoma: the Wynnewood Refining Company.

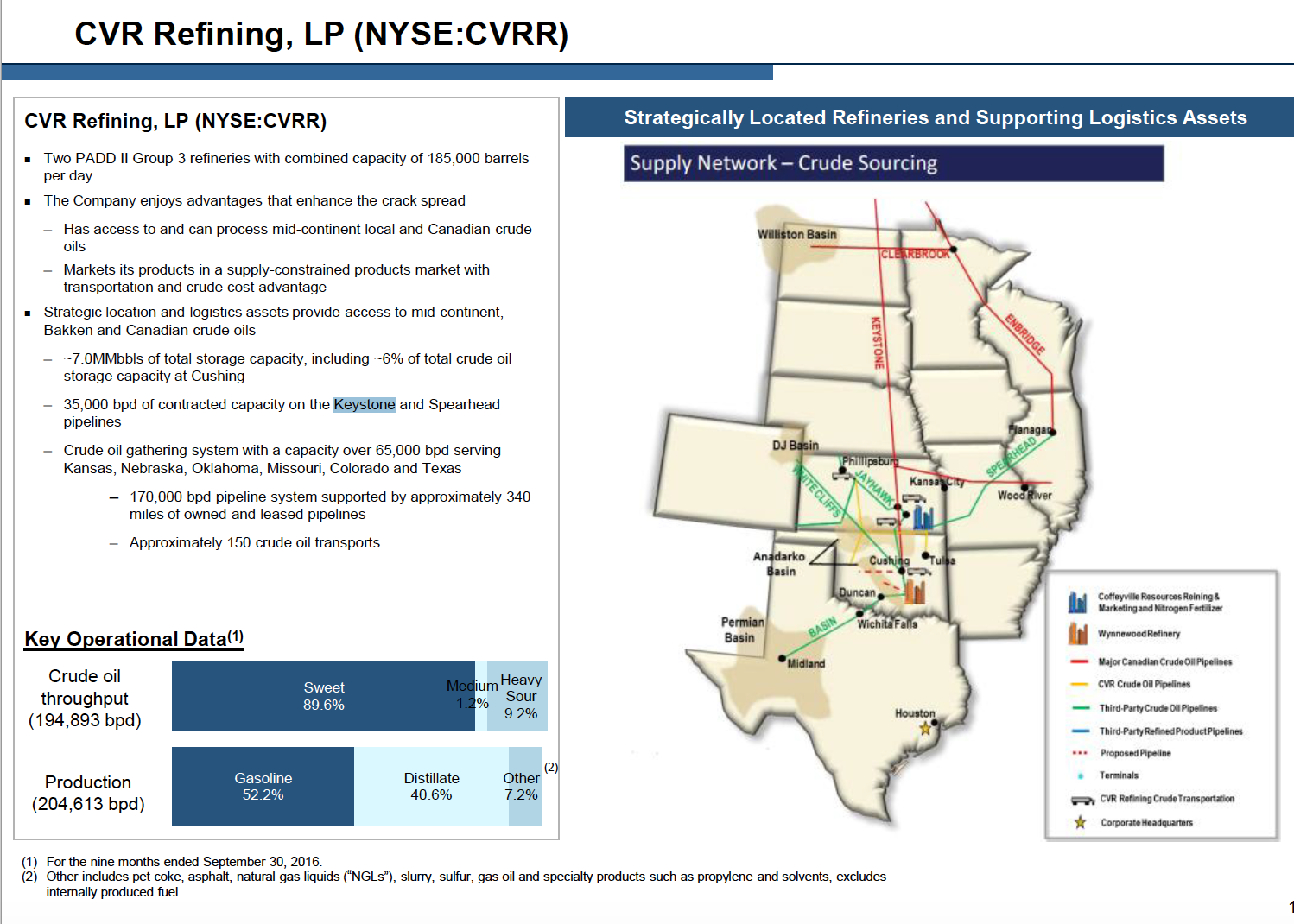

Wynnewood is a 70,000-barrel-per-day oil refinery situated in Wynnewood, Oklahoma, and is a subsidiary of CVR Energy, a company owned by Icahn Enterprises. Carl Icahn chairs CVR Energy’s Board of Directors.

In 2005, Koch Industries helped build an expansion project for Wynnewood, which boosted its refining capacity from 55,000 barrels per day to its current capacity. According to a story published by UPI, that expansion allowed the site to “process heavy, high-sulfur crude oil,” otherwise known as tar sands crude.

Koch Industries has given Pruitt $10,000 in campaign contributions throughout his political career in Oklahoma.

Up to 35,000 barrels per day of that tar sands oil, according to Icahn Enterprise’s November 2016 Investor Presentation, flows through TransCanada’s Keystone Pipeline. That’s the Alberta, Canada-to-Cushing, Oklahoma pipeline authorized into existence by President George W. Bush in March 2008.

That tar sands oil also flows through what DeSmog has dubbed Enbridge’s “Keystone XL Clone” pipeline system, which like Keystone, brings Alberta’s tar sands oil to Gulf of Mexico refinery markets.

Image Credit: Icahn Enterprises

“As part of our crude oil gathering and logistics business, we have built 1 million barrels of owned tankage at Cushing, Okla., the oil trading hub through which we supply our non-gathered barrels to both the Coffeyville and Wynnewood refineries,” CVR detailed in its 2011 Annual Report. “Combined with our 3 million barrels of leased storage in Cushing, we now have even more flexibility to benefit from the wide range of crudes available at Cushing, especially heavy Canadian crudes and crudes from the Bakken and other fields in the northern Midcontinent.”

Wynnewood also receives some of its crude oil from the Blueknight Pipeline, according to CVR Refining LP‘s most recent U.S. Securities and Exchange Commission (SEC) report. In 2012, Blueknight signed a deal with XTO Energy — a subsidiary of ExxonMobil — to feed its oil obtained via hydraulic fracturing (“fracking”) from Oklahoma’s Woodford Shale basin into Wynnewood.

XTO, which owns a huge amount of land in the Woodford basin, has given $6,500 in campaign contributions to Pruitt throughout his political career.

EPA Violations, Other Assets

In its most recent SEC quarterly report filed on November 3, Icahn Enterprises discussed the detrimental role regulations could have on its profit-margin bottom line at the Wynnewood facility, referred to in the report as “WRC.” Icahn Enterprises wrote that environmental protection “laws and regulations could result in increased capital, operating and compliance costs” for Wynnewood.

Image Credit: U.S. Securities and Exchange Commission

The EPA‘s Detailed Facility Report for Wynnewood documents that in the past five years, Wynnewood has spent 12 out of 20 quarters in significant violation of the Clean Air Act and been subject to four formal enforcement actions and another 13 informal enforcement actions.

In 2014, the facility released more than 2.8 million pounds of volatile organic compounds (VOCs), which are chemical substances that if inhaled, can cause cancer and other illnesses. The list of carcinogenic VOCs emitted by Wynnewood includes benzene and ethylene.

According to EPA data, in 2015 Wynnewood emitted 825,437 metric tons of carbon dioxide (CO2), 13,534 metric tons of methane, and 213,776 pounds of toxins (as defined by the EPA‘s Toxic Release Inventory). That refinery’s 2015 CO2 and methane emissions are equivalent to driving 245,831 passenger vehicles for a year and using a year’s worth of electricity for 171,853 homes, according to the EPA‘s Greenhouse Gas Equivalencies Calculator.

Beyond CVR Energy, Icahn Enterprises also owns a 13.8-percent stake in fracked gas exporting giant Cheniere and an 8.46-percent stake in prospective fracked gas exporter and mining giant Freeport-McMoran. Until recently selling its stake, Icahn also held a 4.55-percent stake in the Oklahoma-based fracking goliath Chesapeake Energy.

In December 2013, the EPA and U.S. Department of Justice handed Chesapeake a $9.7 million fine for multiple violations of the Clean Water Act, the largest fine ever given to a company for this kind of violation.

That violation included “27 sites damaged by unauthorized discharges of fill material into streams and wetlands” and required the company “to implement a comprehensive plan to comply with federal and state water protection laws at the company’s natural gas extraction sites in West Virginia, many of which involve hydraulic fracturing operations,” according to the EPA press release announcing the fine.

Chesapeake also received a $600,000 fine from the EPA in 2012 because it had “discharged [60] tons of crushed stone and gravel into Blake Fork, a water of the United States, on at least three different occasions in December of 2008,” explained the EPA in a press release. The company has given Pruitt $11,500 in campaign money during his political career.

These types of enforcement actions, suffice to say, likely won’t take place under Pruitt’s watch.

“Pruitt’s nomination is historic. No one has ever headed the EPA with his level of anti-science, anti-environmental record, which includes multiple lawsuits against the EPA intended to prevent the EPA from doing its job. Which is now supposed to be his job,” wrote Jay Michaelson in the Daily Beast.

“Wholly Owned Subsidiary”

The Center for Biological Diversity used an apt business metaphor to decry Trump’s nomination of Pruitt to head the EPA.

“Pruitt is a wholly owned subsidiary of the oil industry,” said Kassie Siegel, director of the Center for Biological Diversity’s Climate Law Institute, in a statement. “Nominating him to lead the agency that protects our air, water, and climate from pollution is like putting the Swamp Thing in charge of draining the swamp.”

But if Pruitt is the subsidiary and Trump is the boss, then who’s the owner? Carl Icahn, of course.

Update: The day after the Pruitt EPA hire announcement, CVR Energy’s stock price rose 17.17-percent, up $3.63 and to $24.77 per share. The stock market analysis site Fool.com attributed the bump directly to the connection Icahn had to the hire.

“It also just so happens that Icahn was very influential in the nomination of the next U.S. EPA administrator as he actually interviewed several of the candidates and gave his feedback to President-elect Trump,” they wrote. “As you can imagine, Wall Street is going to act very favorably when the person with a controlling stake in your company gets to play a large role in naming the person that will regulate your business.”

Main image: Pixabay

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts