President Trump’s nominee to head the Federal Energy Regulatory Commission (FERC) has, as a corporate attorney, personally represented a host of energy and utility companies, many of which do business that is directly impacted by FERC’s decisionmaking. According to Kevin McIntyre’s financial disclosure — obtained by DeSmog and published here for the first time — these include major utilities, fracking companies, pipeline builders, and international energy corporations.

McIntyre is a lawyer who co-leads the global energy practice for the legal and lobbying firm Jones Day, and is currently awaiting final Senate confirmation of his appointment to the nation’s top energy regulatory body. That confirmation may come as soon as this week.

McIntyre’s financial disclosure, submitted recently to the Office of Government Ethics, reveals that in the past two years alone he has represented various energy and utility companies. Some of these companies are regulated by FERC or have projects seeking FERC approval.

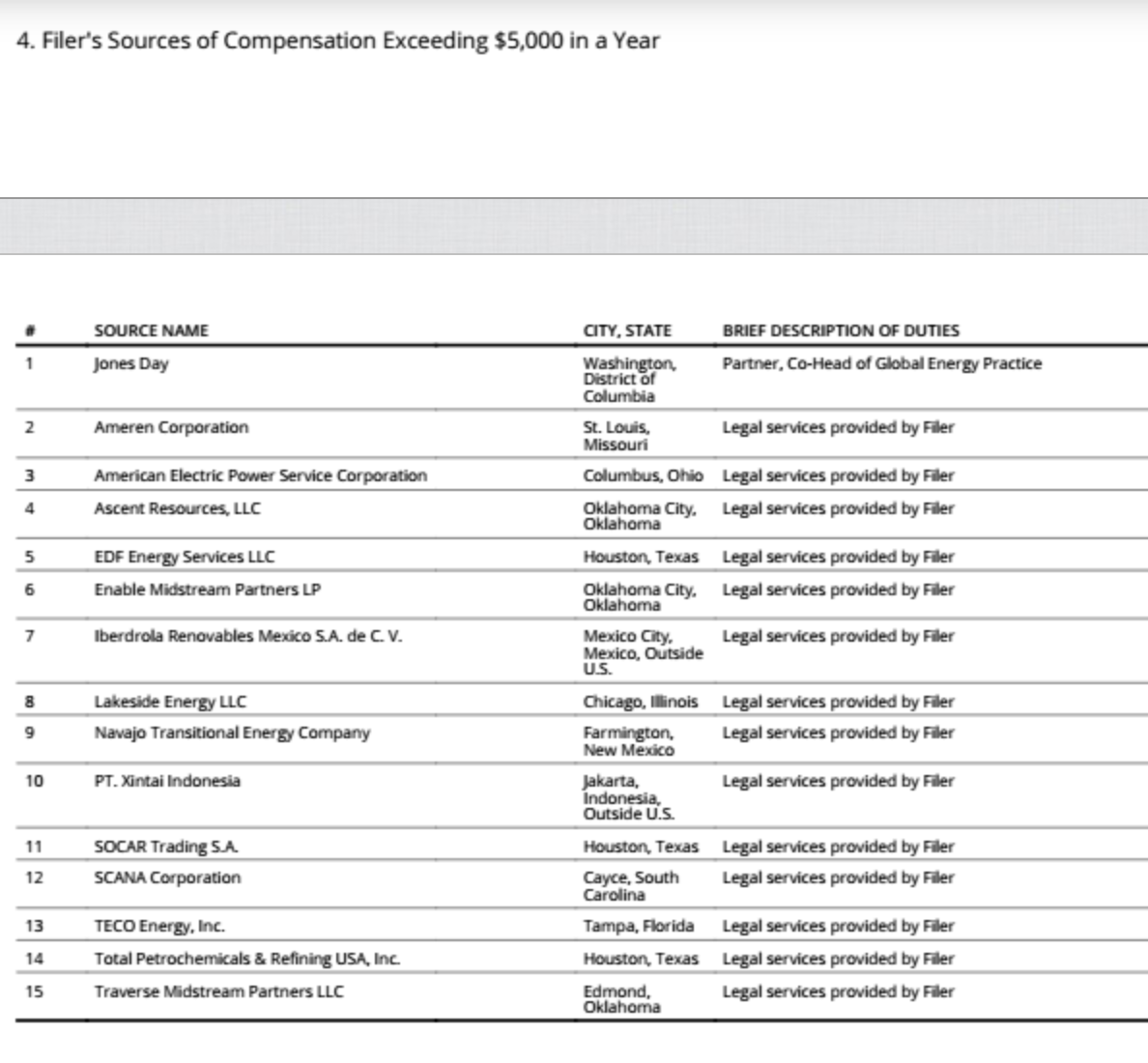

The list includes the following entities:

- Ameren Corporation, a St. Louis, Missouri-based utility and power generation company. Ameren delivers electricity and distributes gas to over 1 million customers in Missouri and Illinois. The company owns several power-generating plants running on coal, gas, and oil. It also operates nuclear, hydroelectric, and renewable facilities.

- American Electric Power Service Corporation (AEP), a large Columbus, Ohio-based electric utility supplying customers throughout the Midwest and Southwest US. The company owns about 60 power generating facilities, of which coal-fueled plants account for approximately 47 percent of AEP’s generating capacity, while natural gas represents 27 percent and nuclear 7 percent.

- Lakeside Energy LLC, a Chicago-based energy holding firm that targets independent power generating and renewables industries.

- Navajo Transitional Energy Company, a Farmington, New Mexico-based coal mining company owned by the Navajo Nation. The company supplies coal to the nearby Four Corners power plant.

- SCANA Corporation, a Cayce, South Carolina-based energy holding company engaged primarily in electric and gas utility operations in the Carolinas and Georgia. The company also owns nuclear, hydroelectric, coal, and renewable power generating facilities.

- TECO, a Tampa-based electric and gas utility providing services to customers in Florida and New Mexico. TECO is a subsidirary of Canadian energy and services giant Emera, which owns $29 billion in assets in North America and the Caribbean.

- Traverse Midstream Partners, an Edmond, Oklahoma-based pipeline company with stakes in the Rover pipeline and Ohio River System pipeline. In both pipelines, Traverse partners with Energy Transfer Partners, the company behind the Dakota Access pipeline.

- Ascent Resources, an Oklahoma City-based oil and gas exploration and production company that focuses on fracking in the Utica and Marcellus shales in Ohio and West Virginia.

- Enable Midstream Partners, an Oklahoma City-based oil and gas gathering, processing, and transmitting company with operations in Oklahoma and Arkansas. One of Enable’s current proposed pipeline projects, the Central Arkansas Pipeline Expansion (CAPE), will require FERC approval.

- EDF Energy Services LLC, a Houston-based subsidiary of French utility EDF, the company provides electricity, natural gas products and services to large-scale, energy-intensive commercial and industrial consumers in the US and Canada.

- PT. Xintia Indonesia, an Indonesian company providing drilling equipment and services to the oil and gas industry.

- SOCAR Trading S.A., a Geneva Switzerland-based company which is the marketing and development subsidiary of SOCAR, the state oil company of Azerbaijan. SOCAR Trading markets the bulk of Azeri crude exports.

- Total Petrochemical & Refining USA, Inc., a Houston-based subsidiary of French oil and gas major Total involved in the production of various petrochemical materials with facilities in Texas and Louisiana.

- Iberdrola Renovables Mexico S.A. de C.V., a Mexican subsidiary of Spanish electric utility giant Iberdrola, focusing on renewable energy investments in Mexico.

Screenshot from McIntyre’s financial disclosure.

Concern Over Industry Ties

After a number of resignations and term expirations, as of this past June the FERC‘s bench had dwindled down to one single commissioner. The Trump administration has nominated four new candidates to restore the quorum needed for FERC to make key decisions.

Industry representatives lauded the reestablishment of a quorum on the commission, which can now approve the logjam of pending energy projects.

Critics, however, have sounded the alarm about some of the new appointees’ industry ties. Protesters with the group Beyond Extreme Energy had disrupted two Senate confirmation hearings in recent months.

They’ve pointed out that the newest FERC appointees Neil Chatterjee and Rob Powelson have ties to fossil fuel companies and utilities. While Chatterjee previously worked as an energy policy advisor to Senate Majority Leader Mitch McConnell (R-KY), Powelson developed a close relationship with the industry as a state utilities regulator.

As DeSmog recently reported, Powelson received gifts from industry in his previous regulatory position.

Kevin McIntyre’s financial disclosure adds fuel to these concerns. McIntyre did not respond to a request for comment.

Tyson Slocum, director of the energy program at the government watchdog group Public Citizen, says the disclosure is cause for further concern. “I do think FERC has had problems of not accommodating the public interest as much as is spelled out in its statutory requirements,” Slocum says. “And McIntyre’s list of clients does not appear to include public interest clients, whereas today there is much opportunity for lawyers to represents such clients as well.”

Slocum adds that as co-lead of Jones Day’s energy practice, McIntyre is probably privy to other kinds of key information about energy clients, beyond those entities listed as the ones he personally represented at the firm.

“This complicates the question of potential conflicts beyond the list he provided in the disclosure since there’s uncertainty as to that kind of information he may hold,” Slocum says.

Main image credit: BranderGuard via Flickr CC

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts