By Olaf Weber, Truzaar Dordi, and Vasundhara Saravade of the University of Waterloo.

Recently, a number of institutional investors, including Caisse de dépôt et placement du Québec in Canada and Norway’s sovereign wealth fund, announced their intent to reduce their exposure in investments linked to fossil fuels.

The announcements show that investors withdraw their funds to either mitigate financial risks or for ethical reasons. But the question remains whether divestment and divestment announcements have a financial impact on the share price of fossil fuel companies.

We’re a team of researchers at the School of Environment, Enterprise and Development (SEED) at the University of Waterloo. We recently conducted an analysis that suggests divestment announcements have a statistically significant negative impact on the price of fossil fuel shares. Our study aggregates the impact of more than 20 announcements across 200 publicly traded fossil fuel companies.

The results suggest that share prices dropped on the days that institutional investors announced they were divesting of fossil fuels.

We’ve concluded that investors, and the market as a whole, perceive divestment as integral to the long-term valuation of the fossil fuel industry. Lower share prices increase the costs of capital for the fossil fuel industry, which in turn decreases their ability to explore new resources and exploit proven resources.

And if the majority of proven reserves remains in the ground, we may be able to meet our climate change goals.

Reserves Must Stay Grounded

The continued exploitation of fossil fuel reserves alone has the potential to increase greenhouse gases and global temperature well beyond the 2°C threshold required to prevent the worst effects of climate change.

To achieve the 2°C target, however, no more than one-fifth of the current proven fossil fuel reserves can be burned.

The necessity to keep the resources in the ground has a direct impact on the valuation of fossil fuel industry assets. They are predominantly influenced not only by production, but also by the value of proven fossil-fuel reserves. In other words, if these resources cannot be exploited, their value will depreciate.

A sudden depreciation would lead to a burst of the so-called carbon bubble, leaving fossil fuel investments stranded.

To avoid the risk of stranded assets, a number of influential private and institutional investors have pledged to reduce their fossil fuel investments or divest from the fossil fuel industry entirely.

Ethical Motivations

Other investors are motivated to divest from fossil fuel shares for ethical reasons. They do not want to be part of an industry that is one of the main drivers of climate change.

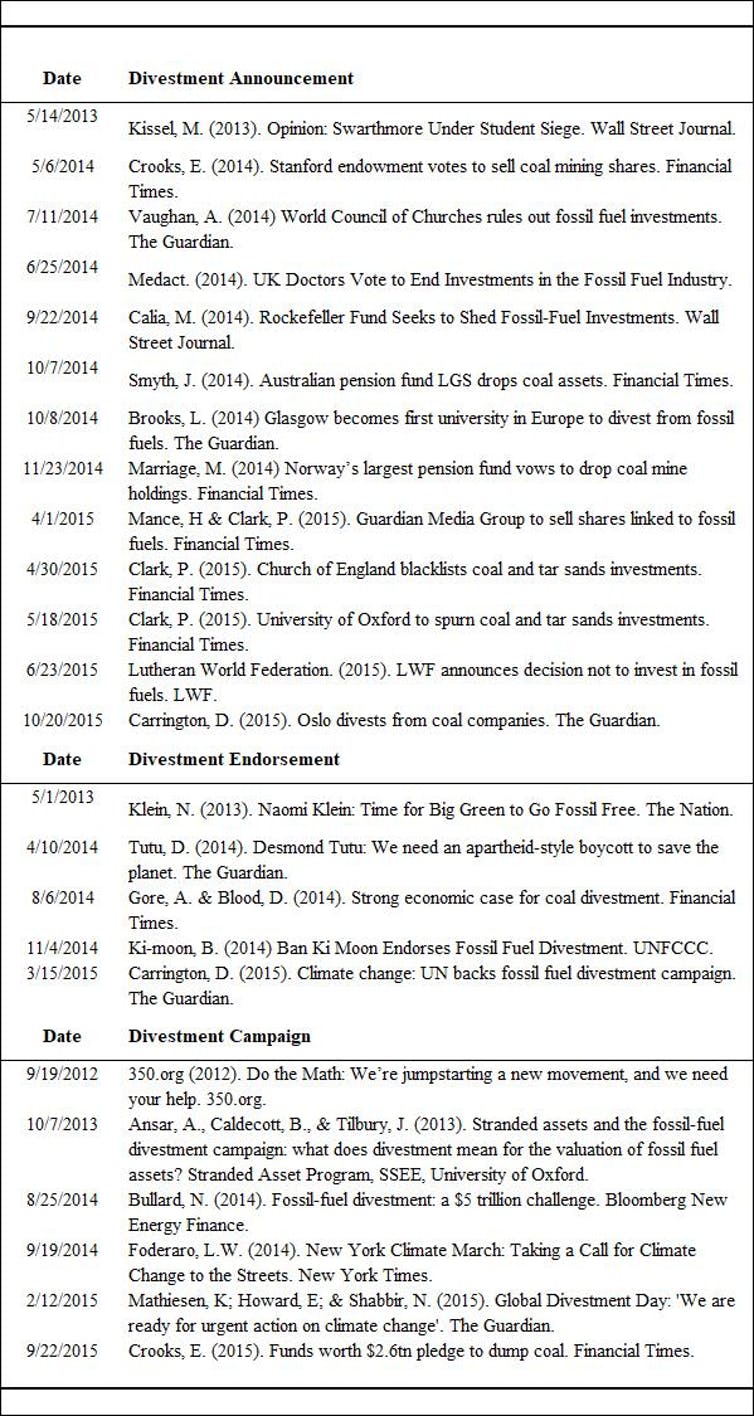

To explore the financial impact of divestment announcements on the share price of fossil-fuel sector companies, we analyzed 24 divestment announcements, endorsements and campaign events between 2012 and 2015 (see the list below).

These events received a lot of media coverage, with stories appearing in publications that included the Financial Times and the Wall Street Journal.

Our sample of fossil fuel industry representatives included 200 coal, oil and gas firms listed in Carbon Underground 200, which identifies the top publicly traded companies with the highest potential greenhouse gas emissions based on their reserves.

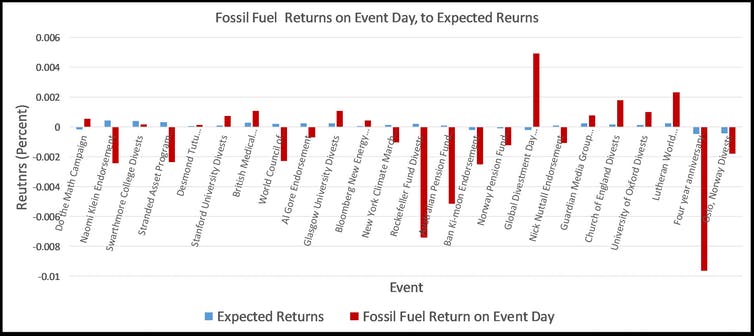

A comparison of the share prices of fossil fuel shares and a global benchmark at the time of a divestment announcement suggests significant differences.

While the general benchmark — the MSCI All Country World Index (ACWI) — has not been affected by the announcements, the fossil fuel share prices decreased, as shown below:

The results suggest that fossil fuel companies experienced statistically significant negative abnormal returns on the day of a divestment announcement, and in the days following the announcement. Furthermore, our findings demonstrate that more recent divestment announcements had a stronger impact on share prices than earlier such announcements, suggesting a snowball effect.

In May 2014, for example, Stanford University’s divestment announcement resulted in a negative abnormal return of .009 per cent in the ensuing 10 days for companies listed on the Carbon Underground 200.

A few months later, in September 2014, the Rockefeller Foundation divestment announcement resulted in a negative abnormal return of -.22 per cent over the following 10 days. And two months after that, the divestment announcement by the Norwegian sovereign wealth fund resulted in -.24 percent for the shares of the companies listed on the Carbon Underground 200.

Markets Respond

It seems financial markets are increasingly aware of the importance of divestment.

Divestment announcements by prominent investors signal financial risks to the market, which in turn depress share prices. Therefore, divestment announcements can have a measurable impact on the fossil fuel industry.

The market response to divestment can be either direct or indirect. Market players might directly perceive the announcements of big institutional investors as signalling an increased financial risk to the divested industry. If big market players announce that they divest, others follow.

Alternatively, divestment announcements might have an indirect impact on the reputation of fossil fuel companies. Tarnished reputations weaken confidence and trust in the long-term value of these shares and decreases their price.

Whether the impact is direct or indirect, decreasing share prices make acquiring financial capital more expensive for the fossil fuel industry.

This in turn lowers their ability to explore new resources, exploit proven reserves and secure long-term growth. In other words, lowering fossil fuel industry share prices via divestment can lead to lower productive capacity — and, consequently, to lower greenhouse gas emissions.

Olaf Weber, Professor of Sustainable Finance and Banking, University of WaterlooTruzaar Dordi, PhD Candidate, Sustainable Finance, University of Waterloo, and Vasundhara Saravade, Masters Candidate in Environmental Finance and Sustainability Management, University of Waterloo

This article was originally published on The Conversation. Read the original article.

Main image: Overpass Light Brigade at Bascom Hall, Madison, Wisconsin, 4/4/14. Credit: depthandtime, CC BY–NC 2.0

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts