By Rob Galbraith, Cross-Posted from LittleSis.org

Clarification, 1/22/2018: This article and the underlying report identified a conflict of interest between former Senator Mary Landrieu and the Coastal Protection and Restoration Authority (CPRA), a state agency that needed to sign off on Bayou Bridge pipeline before construction could begin. Landrieu, who is registered to lobby for CPRA, is also advocating for the Bayou Bridge pipeline. The necessity of CPRA’s approval for the pipeline was identified by Energy Transfer Partners (ETP), the majority owner, in a statement on December 14, 2017 as well as in reporting based on that statement.

Public Accountability Initiative has learned that CPRA issued a letter of no objection to the pipeline project on December 19, 2017. ETP’s statement about needing the approval, which was still on the Bayou Bridge website when the report was published, has since been removed.

This article has been updated to clarify that the necessary approval from CPRA has been issued.

From Dakota Access to Keystone XL to Atlantic Coast, there has been no shortage of controversies over major proposed oil and gas pipelines in recent years. We can add the Bayou Bridge pipeline to this list.

Energy Transfer Partners and Phillips 66’s Bayou Bridge pipeline is a proposed connection to ETP’s Bakken pipeline network that will ship between 280,000 and 480,000 barrels of crude oil per day through southern Louisiana’s bayous and wetlands to petroleum refineries in St. James.

The pipeline is facing committed resistance, both from environmental activists concerned about climate change and the impact of inevitable pipeline leaks and accidents on the environmentally sensitive Atchafalaya Basin, as well as from the communities of people whose homes and ways of life are threatened by the project.

On the other side are the oil and gas corporations that stand to profit from building the pipeline, the banks seeking interest payments on loans to oil and gas companies, and the politicians and academics dependent on oil and gas industry largesse for their careers.

Public Accountability Initiative’s latest report — “The Power Behind the Pipelines: Bayou Bridge Pipeline” — examines the interests pushing Bayou Bridge despite the substantial public opposition.

Former Senator Mary Landrieu working for ETP and key environmental regulator

The most shocking find in our investigation was that Mary Landrieu, the former Democratic senator from Louisiana, has been working as a consultant for Energy Transfer Partners touting the pipeline in public testimony and in print media at the same time as she is registered as a lobbyist for the Louisiana Coastal Protection and Restoration Authority, which needed to approve Bayou Bridge before the project could move forward.

It is not entirely clear whether Landrieu is being paid by Energy Transfer Partners, and if so, how much. She is not registered to lobby on behalf of ETP at the state or federal level, however the former senator identified herself as a consultant for the firm in an article endorsing the pipeline and reportedly told protesters that “she would support the project even if she wasn’t working for the company.”

At the same time, Landrieu is registered to represent the Louisiana Coastal Protection and Restoration Authority, one of the final regulatory agencies to approve of Bayou Bridge, to the federal government.

These dual roles — working both for an environmental regulator and an energy company with a project that must be approved by the regulator — pose an extraordinary conflict of interest.

Landrieu is a powerful politician who served in the US Senate for 18 years and whose family is heavily involved in Louisiana politics. During her time there, she received more than $1.7 million from the oil and gas industry, including $41,400 from Energy Transfer Partners. Her formidable connections and conflicting positions raise questions of whether she may by influencing CPRA on behalf of ETP.

Banks that signaled an end of pipeline financing are lending to Bayou Bridge

Our other most notable finding was that two banks — US Bank and DNB Capital — that had pledged they would stop financing ETP’s Dakota Access pipeline after public pressure on them to do so were lending to the companies behind Bayou Bridge.

In the case of US Bank, after Food & Water Watch’s Hugh MacMillan revealed the banks financing Dakota Access spurred a pressure campaign that included a banner drop at a Minnesota Vikings game at US Bank Stadium, the bank announced to great accolades that it would cease “project financing for the construction of oil or natural gas pipelines.”

Crucially, US Bank did not pledge to stop lending to the companies building pipelines, but merely pledged to stop financing individual projects. This distinction is academic, however, since corporate debt is in fact financing pipeline construction. In its most recent annual report, Energy Transfer Equity, ETP’s parent company, said that ETP’s credit facility would provide “temporary financing for growth projects,” which includes Bayou Bridge.

In December 2017, eight months after their announcement US Bank joined other banks in two new agreements to lend up to $5 billion to Energy Transfer Partners, the main company behind Dakota Access and the majority owner of Bayou Bridge. US Bank is also party to credit agreements to lend up to $5.75 billion to Phillips 66.

DNB Capital, a Norwegian bank which had been a member of credit agreements with Energy Transfer Equity and both Energy Transfer Partners and Sunoco Logistics Partners before their merger, announced that it would sell off its loans to Energy Transfer Partners “to signal how important it is that the affected indigenous population is involved and that their opinions are heard in these types of projects.”

However, DNB Capital remains party to credit agreements with Phillips 66, which is a 25 percent owner of Dakota Access and a 40 percent owner of Bayou Bridge.

The banks’ announcements about pulling financing from Dakota Access show that public pressure campaigns like Mazaska Talks have had an impact, however the fact they are still finding ways to finance pipeline construction that threatens the environment and the sovereignty of indigenous people shows that the promise of oil profits still has major allure.

More in our report and Q&A

For more information on the power behind Bayou Bridge pipeline — including other politicians backing the pipeline, the major investors like Blackstone and Berkshire Hathaway invested in the companies behind it, and the significant conflicts of interest at Louisiana State University which published a report touting the pipeline — see our full report, available at the Public Accountability Initiative website.

Robert Galbraith, the author of the report, will be available for a Q&A on Tuesday, January 16 at 2pm Eastern time. You can join the Q&A by clicking this link or by dialing (646) 876-9923 and entering the meeting ID 651 564 799.

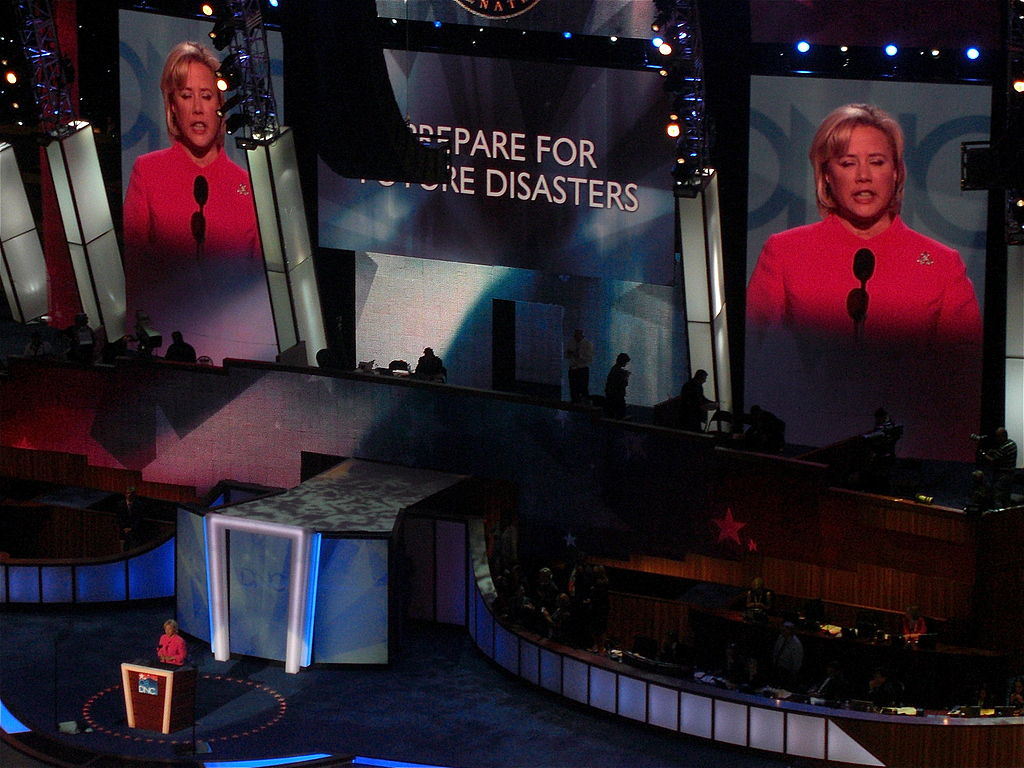

Main image: Mary Landrieu speaks at the 2008 Democratic National Convention. Credit: Qqqqqq, CC BY–SA 3.0

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts