In April, the Department of Justice informed Southern Company that it was under investigation “related to the Kemper County energy facility” in Mississippi, where Southern had spent $7.5 billion, including hundreds of millions in taxpayer funds from the Department of Energy, trying to build a coal-fired power plant that would capture carbon emissions.

Former engineers and officials from the Kemper plant have described evidence of possible intentional fraud at the construction project, alleging that the company knew of design flaws early on but pressed forward with the project in the hopes that costs could be passed on to power customers even if the project ran severely over-budget.

But the while the company remains under investigation, the Trump administration is doubling down by offering new funding — not just millions for more “clean coal” research and development, but also billions more for another construction project, which is also far behind schedule and over-budget, by the same company.

In April, the same month that Southern learned of the Justice Department investigation, the Department of Energy’s Office of Fossil Energy announced it would offer $100 million of federal taxpayer money to fund research and development for new coal power plants that would use carbon capture technology.

A month earlier, Trump’s Energy Secretary Rick Perry also announced $3.7 billion in federal loan guarantees for another Southern Company project, the Vogtle nuclear power plant.

Nuclear Loan Guarantees

Southern Company disclosed the investigation by the Civil Division of the Department of Justice to investors in required Securities and Exchange Commission (SEC) filings earlier this month, warning that it could have a “material impact” on profits for Southern’s Mississippi Power Co. subsidiary.

The Kemper project had been offered over $380 million in federal grants from the Department of Energy (DOE) to generate affordable electrical power from coal with carbon capture — but it ultimately only produced electricity from its troubled “clean coal” equipment for roughly 100 hours before the company abandoned work on the over-budget and behind-schedule project in 2017.

The Justice Department investigation comes after The Guardian revealed that Southern officials kept evidence of design flaws and construction problems under wraps at what was promised to be the world’s largest “clean coal” power plant — but which proved to be inoperable.

The Securities and Exchange Commission had mothballed an earlier investigation into the Kemper project without reaching conclusions before the new evidence came to light.

Violations of the False Claims Act, often used by the federal government to sue those who defraud government programs, can potentially carry triple the damages.

Southern has already racked up $6.4 billion in losses from Kemper, according to the Associated Press. It also warned investors this month that it will face additional costs related to closing Kemper’s on-site coal mine and a pipeline that would have carried its captured carbon dioxide from Kemper to the Gulf Coast, for use by the oil and gas industry.

Local utility regulators have warned that Southern should not expect to recoup those costs from power customers. “I think the commission has made clear two years ago that recovery from the Mississippi customer is closed for Kemper County,” Mississippi Public Service Commissioner Brandon Presley told the Associated Press when the DOJ investigation came to light.

In February 2018, Southern announced that Ernest Moniz, former Secretary of the Department of Energy, would join the company’s board of directors. Moniz had championed the Kemper project during his time at DOE. “Projects like Kemper represent the future of fossil energy — and are evidence of the Department of Energy’s commitment to #ActOnClimate by advancing technologies that make coal more efficient, economical and environmentally sustainable,” Moniz, an Obama appointee, wrote five years earlier after visiting the Kemper project.

The Trump administration has now doubled down on funding for another troubled Southern Company project.

In preparation for our annual meeting tomorrow, we want to recognize the milestones at Vogtle Units 3 & 4. Between the top-head placement and visits from energy industry leaders, it has been an historic year for Vogtle! pic.twitter.com/mjvU1D3tPJ

— Southern Company (@SouthernCompany) May 21, 2019

Vogtle, the only remaining nuclear power project under construction in the U.S., was originally slated to cost $14 billion total and to start producing power in 2016. Those costs have ballooned to a projected $27.5 billion and the full project isn’t slated to be completed until late 2022.

In March, Sec. Perry announced that the DOE would offer up to $1.67 billion in new loan guarantees to the Southern Company subsidiary, Georgia Power Co., which is building the Vogtle nuclear power plant’s units 3 and 4, along with up to $2.1 billion in financing for the project’s other partners. That’s in addition to $8.3 billion in earlier federal pledges, bringing taxpayer loan guarantees for the nuclear project to roughly $12 billion.

Coal FIRST, Taxpayers Last?

The Department of Energy also continues to spend more taxpayer money on so-called “clean coal” research that has so far produced little progress relative to its costs.

The DOE’s new $100 million Coal FIRST initiative, announced in April, comes at a time when the United Nations warns the entire world must fully stop burning coal for electricity within roughly 30 years.

Coal FIRST will offer companies American taxpayer funding to create small “modular” coal plants that could be transported by 18-wheeler trucks and would use carbon capture technology to offer “near-zero” emissions.

Trump administration officials have said the miniature coal power plants would be marketed to “the developing world” because there’s no domestic demand for them.

International investors in coal (and you know who you are) often claim that they are only funding the projects that countries want. So we asked YouGov to poll the public in key recipient countries & it turns out they want clean energy not coal. @RHarrabin @dpcarrington @ftenergy https://t.co/cWpyNbwPrR

— Nick Mabey (@Mabeytweet) April 26, 2019

“Building a new coal plant today is a bad idea, and building small, modular coal plants is an especially bad idea,” John Walke, director of the Natural Resources Defense Council’s Clean Air Project, told Inside Sources. “They are still dirty, and the costs just don’t add up.”

Top Trump officials have described the possibilities for federal “clean coal” research in even more ambitious terms. “And through the remarkable technology of carbon capture utilization and storage or CCUS,” Sec. Perry said at an April speech in Dallas, Texas, “we are advancing innovations that could one day make coal as clean as renewables.”

But so far, after spending billions, the DOE has little evidence to show it’s making progress towards transforming coal into energy as clean as wind or solar.

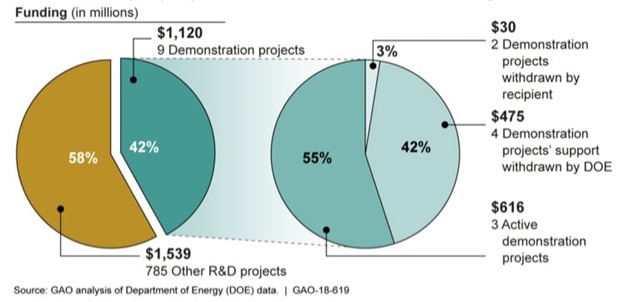

A September 2018 Government Accountability Office report tallied $2.66 billion in Department of Energy funding since 2010 for “advanced fossil energy technologies.” The DOE spent $1.12 billion on nine large projects to meant demonstrate that carbon capture and storage could be affordably used, plus another $1.54 billion on smaller projects, 89 percent involving the use of coal.

What does DOE have to show for that spending? Of those nine projects, six were never finished and by 2017, only the Petra Nova power plant was producing power from coal while using carbon capture.

Whether that “clean coal” power can match the affordability of wind or solar, however, is another question. “While the economics of carbon capture and Petra Nova remain challenging,” David Knox, a spokesperson for builder NRG, which will receive DOE funding for Petra Nova until the end of this year, told trade publication POWER, “the plant is running as designed and has captured more than two million tons of CO2.”

Two million tons of carbon sequestration would be on par with the benefits of preserving roughly 25 square miles of U.S. forests (instead of converting them to cropland) for one year, according to Environmental Protection Agency (EPA) data.

Kemper also isn’t the only DOE-backed project to draw allegations of fraud. The Clean Coal Power Initiative, run by the same Office of Fossil Energy now behind the Coal FIRST program, was faulted by the Department of Energy’s inspector general last year for failing to collect receipts or invoices for $38 million in federal funds distributed for an “advanced coal-based technologies” project that was never built. At least $2.5 million was in fact spent on lobbying, alcoholic drinks, and “social” expenses, including limos, spa trips and catering on a private jet, auditors discovered.

There are other, more cost-effective ways to avoid carbon pollution while generating electricity. Each year, “wind and solar are displacing roughly 35 times as much CO2 every year as the complete global history of CCS,” an analysis by Clean Technica, reported last month by DeSmog, concluded.

Some utilities are in fact now proposing to do away with coal power all together. Xcel Energy announced on Monday that it would close its last two coal power plants a decade early, drawing support from environmental groups like the Union of Concerned Scientists despite the utility’s plans to continue using nuclear and natural gas power.

Other environmental organizations warn that continued funding for carbon capture not only offers false hope that coal can be “clean,” but it also undermines progress toward more realistic goals.

Incentivizing carbon capture “through policy and relying on it in planning will likely slow the transition away from fossil fuel investments and undermine broader efforts to mitigate climate change,” a March report by the Center for International Environmental Law concluded. “Confronting the challenge of climate change is not a matter of future technology, but present political will and economic investment.”

Main image: Kemper power plant under construction. Credit: XTUV0010, CC BY–SA 3.0

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts